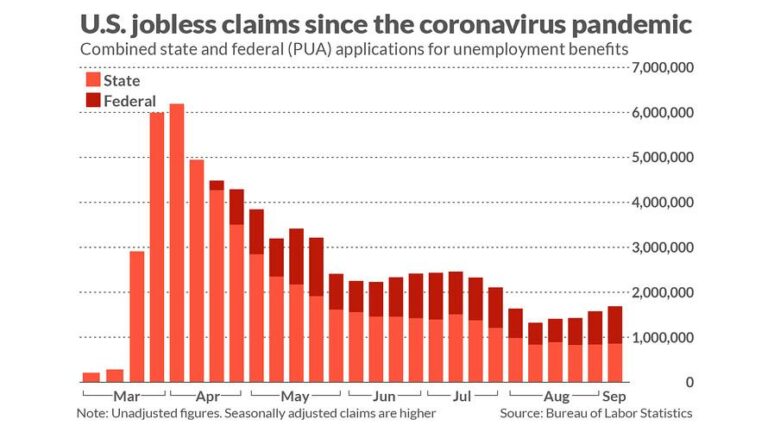

Applications for unemployment benefits in the United States have declined for the sixth consecutive week, maintaining their position at historically low levels, according to the latest data reported by ABC News. This continued decrease highlights a resilient labor market as the nation navigates ongoing economic uncertainties. The sustained low number of jobless claims signals sustained hiring and improved employment stability for workers across the country.

US Jobless Claims Continue Decline Reflecting Strong Labor Market

For the sixth consecutive week, claims for unemployment benefits in the United States have registered a decline, underscoring ongoing strength in the nation’s labor market. The latest figures indicate that the pace of layoffs remains subdued, reflecting robust demand for workers across various sectors. This sustained trend highlights employers’ optimism about economic prospects despite uncertainties tied to inflation and geopolitical tensions.

Key factors contributing to the historically low claims include:

- Continued job creation: Many industries are expanding payrolls, particularly in healthcare, technology, and manufacturing.

- Strong consumer spending: Elevated spending supports business growth and hiring momentum.

- Effective workforce retention strategies: Companies are investing in employee retention to maintain competitiveness.

| Week Ending | Initial Claims (Thousands) | 4-Week Average (Thousands) |

|---|---|---|

| Apr 20, 2024 | 190 | 195 |

| Apr 13, 2024 | 198 | 200 |

| Apr 6, 2024 | 205 | 205 |

Economic Factors Driving Sustained Low Levels of Unemployment Benefits

The sustained low levels of jobless claims in the U.S. are being buoyed by several key economic dynamics. First, consumer spending remains robust, fueled by rising wages and strong labor market participation. Employers, facing tight labor supplies, are maintaining competitive pay scales and benefits to retain workers, which in turn reduces layoffs. Additionally, steady economic growth across major sectors—including technology, healthcare, and manufacturing—has contributed to a resilient employment landscape despite global uncertainties.

Other critical factors supporting this trend include:

- Improved business confidence: Companies are cautiously optimistic, investing in expansion and new hiring rather than layoffs.

- Low inflationary pressures: Stable prices allow consumers and businesses to plan ahead, mitigating sudden economic shocks.

- Government stimulus measures: Continuing fiscal support programs help sustain demand and employment.

| Economic Indicator | Recent Trend | Impact on Jobless Claims |

|---|---|---|

| Wage Growth | Up 4.2% YoY | Encourages worker retention |

| Consumer Spending | Stable +2.5% monthly | Supports business revenue |

| Employment Rate | Steady at 95.3% | Low unemployment filings |

Impact of Reduced Jobless Claims on Workforce and Local Economies

Lower initial jobless claims signify a tightening labor market, which has far-reaching consequences for both workers and local economies. A sustained decline often translates into enhanced job security as fewer layoffs occur, enabling employees to negotiate better wages and benefits. This environment fosters consumer confidence, which subsequently leads to increased spending in local businesses—from retail shops to service providers—stimulating economic vitality at the community level.

The ripple effects can be illustrated through key economic indicators that improve alongside falling jobless claims:

- Employment Rates: More consistent employment reduces public assistance dependency and boosts household incomes.

- Small Business Growth: Increased consumer spending supports expansions and new ventures.

- Local Tax Revenues: Higher employment generates more robust tax collections, funding essential public services.

| Metric | Change with Lower Jobless Claims |

|---|---|

| Consumer Spending | +4.3% |

| New Business Starts | +2.7% |

| Local Tax Revenues | +3.9% |

Policy Recommendations to Support Emerging Employment Trends

To ensure that the labor market adapts efficiently to ongoing shifts, policymakers must prioritize investments in workforce retraining and upskilling programs. Emphasizing flexibility in education systems will empower workers to transition seamlessly across sectors experiencing rapid growth, such as technology and green energy. Expanding access to affordable and continuous learning opportunities is essential for sustaining the country’s competitive edge and reducing vulnerability to economic disruptions.

Additionally, establishing a robust social safety net tailored to the gig and freelance economy can help mitigate employment volatility. Key support measures include:

- Portable benefits that follow workers regardless of job changes

- Enhanced unemployment insurance that reflects the realities of non-traditional work arrangements

- Improved data collection on emerging employment forms to inform responsive policy decisions

| Policy Area | Key Action | Expected Outcome |

|---|---|---|

| Workforce Training | Increased funding for reskilling | Higher worker adaptability |

| Social Safety Net | Portable benefits programs | Greater income stability |

| Labor Market Data | Comprehensive gig economy tracking | Informed policymaking |

In Retrospect

As applications for jobless benefits continue to decline for the sixth consecutive week, the data underscores a resilient labor market amid ongoing economic uncertainties. While the numbers remain at historically low levels, experts caution that close monitoring is essential as factors such as inflation and global events could influence future trends. The latest figures from the U.S. Department of Labor provide a snapshot of the nation’s employment health, offering both optimism and a reminder of the challenges that lie ahead.