Tariffs have become a focal point in international trade debates, reshaping economic relations across the globe. But what exactly are tariffs, how do they function, and what motivates their use‚ÄĒparticularly under the administration of former U.S. President Donald Trump? This article delves into the mechanics of tariffs, exploring their intended effects and the strategic rationale behind Trump’s aggressive trade policies, shedding light on a key issue that continues to influence global markets and diplomacy.

Understanding Tariffs and Their Impact on Global Trade

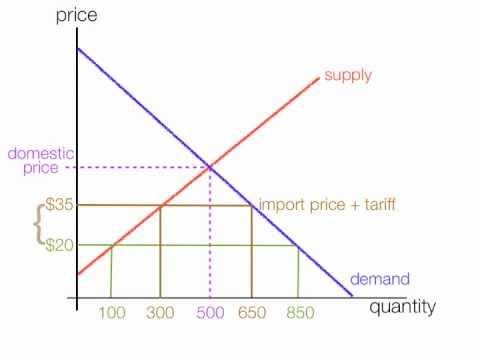

Tariffs represent a form of tax imposed by a government on imported goods and services. Their primary aim is to protect domestic industries from foreign competition by making imported products more expensive. This often results in increased costs for consumers and businesses that rely on international supply chains. While tariffs generate revenue for governments, they can also disrupt global trade flows by prompting retaliatory tariffs, leading to a cycle of escalating trade barriers between countries.

Key impacts of tariffs on global trade include:

- Increased prices for consumer goods, reducing purchasing power.

- Disturbance in supply chains, affecting manufacturing and production schedules.

- Potential for trade wars, where countries impose reciprocal tariffs, damaging international relations.

- Shift in trade patterns, encouraging sourcing from alternative markets.

| Country | Tariff Rate (%) | Primary Sector Affected |

|---|---|---|

| USA | 25 | Steel |

| China | 20 | Agriculture |

| EU | 15 | Automobiles |

How Tariffs Function as Economic Tools in International Relations

Tariffs operate as strategic levers within the complex landscape of international economics, serving governments as both protective shields and negotiation tools. Essentially, they are taxes imposed on imported goods, designed to increase the cost of foreign products and encourage consumers to favor domestically produced alternatives. This dual purpose not only affects trade balances but also influences political dynamics by exerting pressure on exporting countries to comply with trade terms or engage in diplomatic negotiations.

Key functions of tariffs include:

- Protecting emerging industries: By making imported goods more expensive, tariffs give domestic companies a competitive edge to grow and innovate.

- Generating government revenue: Tariffs provide a source of income to national treasuries, particularly in countries where other tax mechanisms are limited.

- Retaliating against unfair practices: They can be used to counteract subsidies, dumping, or other trade policies deemed harmful.

| Tariff Objective | Impact |

|---|---|

| Protective | Supports local manufacturing, job preservation |

| Revenue | Funds public services, fiscal stability |

| Retaliation | Forces trade concessions, balances negotiations |

The Trump Administration’s Motivations Behind Imposing Tariffs

Throughout his presidency, Donald Trump championed tariffs as a strategic tool to address what his administration viewed as unfair trade practices and to revive America‚Äôs manufacturing base. At the core of his approach was a belief that tariffs could pressure trade partners‚ÄĒfor example, China and the European Union‚ÄĒto renegotiate deals perceived as detrimental to U.S. interests. By imposing tariffs on certain imported goods, the administration aimed to protect domestic industries such as steel, aluminum, and automotive manufacturing from global competition allegedly fueled by subsidies, dumping, or intellectual property theft.

Key motivations included:

- Protecting American jobs: Preventing factory closures and job losses by making imported goods more expensive.

- Reducing trade deficits: Attempting to balance trade by encouraging domestic production and reducing dependency on imports.

- Strengthening national security: Shielding industries critical to defense from foreign reliance.

| Motivation | Targeted Sector | Intended Outcome |

|---|---|---|

| Protecting jobs | Steel & Aluminum | Save domestic plants |

| Reducing deficits | Automotive | Boost U.S. manufacturing |

| National security | Defense materials | Limit foreign risks |

Strategic Recommendations for Navigating the Tariff Landscape

To effectively maneuver through fluctuating tariff policies, businesses and policymakers alike should implement a multi-faceted approach. Diversifying supply chains can significantly reduce dependency on any one market vulnerable to tariff shifts, thereby minimizing risks. Additionally, cultivating strong trade alliances and leveraging bilateral agreements serve as vital countermeasures against unilateral tariff hikes.

Prudent financial planning also plays a crucial role. Companies are advised to:

- Regularly update cost forecasting models to include potential tariff impacts

- Explore alternative sourcing to optimize input costs

- Engage in proactive lobbying and diplomacy to influence tariff negotiations

- Invest in domestic production capabilities to mitigate import-related risks

| Strategy | Benefit |

|---|---|

| Diversified Supply Chains | Reduces tariff exposure |

| Trade Alliances | Enhances negotiation leverage |

| Financial Planning | Improves budget resilience |

| Domestic Production | Limits import dependence |

Wrapping Up

In summary, tariffs remain a powerful yet controversial tool in international trade policy. As demonstrated by the Trump administration, their use is often aimed at protecting domestic industries and negotiating leverage, but not without significant economic and diplomatic repercussions. Understanding the mechanics and motivations behind tariffs is essential to grasp the broader implications they have on global markets and relations. The ongoing debate over their effectiveness and impact continues to shape the international economic landscape.