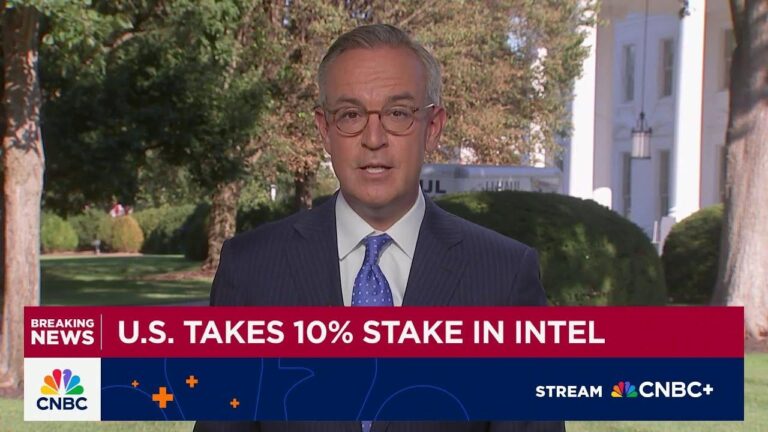

The U.S. government has acquired a 10% stake in semiconductor giant Intel, according to recent statements by former President Donald Trump, as reported by NBC News. This unprecedented move reflects intensifying efforts to secure America’s position in the critical technology sector amid growing geopolitical tensions and supply chain challenges. The investment highlights the administration’s commitment to strengthening domestic manufacturing and technological innovation in an increasingly competitive global landscape.

U.S. Government Acquires Significant Intel Stake Signaling Strategic Industrial Shift

The U.S. government has formally acquired a 10% equity stake in Intel, marking an unprecedented move to realign national industrial priorities. This strategic investment reflects a growing emphasis on domestic semiconductor production amid escalating global supply chain tensions. According to official statements, the decision aims to bolster the nation’s technological independence and secure critical infrastructure against geopolitical disruptions. Former President Donald Trump commented on the development, highlighting it as a decisive step towards reclaiming U.S. leadership in advanced technology sectors.

Industry analysts suggest the partnership will accelerate Intel’s capacity expansion and innovation, with anticipated benefits including:

- Enhanced production capabilities in flagship fabs

- Increased government oversight and collaboration on R&D

- Job creation and revitalization of skilled manufacturing workforce

| Investment Aspect | Projected Impact |

|---|---|

| Capital Infusion | $20 Billion+ to expand fabrication facilities |

| Strategic Collaboration | Joint R&D on next-gen chip technologies |

| Workforce Development | Creation of 15,000+ new high-tech jobs |

Trump’s Reaction and Political Implications of Federal Investment in a Tech Giant

Former President Donald Trump quickly voiced his opinions following the federal government’s announcement of a 10% stake investment in Intel. He framed the move as a strategic repositioning in the global technology race, emphasizing the necessity to bolster American chip manufacturing against rising international competition. Trump’s comments highlighted his enduring focus on national security and economic sovereignty, suggesting that such governmental involvement could be a turning point in revitalizing the U.S. semiconductor industry.

Politically, the decision has ignited debate across party lines. Critics argue that this substantial federal foothold in a private enterprise raises questions about market interference and long-term implications for free enterprise. Conversely, proponents claim that it is a calculated and essential intervention to safeguard technological leadership and protect critical supply chains. The table below outlines some key political reactions:

| Political Faction | Reaction | Focus |

|---|---|---|

| Republicans | Mixed—some welcome the protectionism, others worry about federal overreach | Economic sovereignty, market impact |

| Democrats | Generally supportive, emphasizing innovation and job creation | Tech innovation, workforce development |

| Industry Analysts | Cautiously optimistic about boosting domestic production | Supply chain resilience, global competitiveness |

- National Security: Enhancing control over critical semiconductor technology.

- Economic Policy: Balancing government involvement with free-market principles.

- Geopolitical Strategy: Countering China’s growing dominance in tech manufacturing.

Potential Impact on Intel’s Business Operations and Global Semiconductor Market

The U.S. government’s acquisition of a 10% stake in Intel marks a strategic move that could reshape the company’s operational framework and influence the broader semiconductor landscape. With Washington stepping in as a significant shareholder, Intel is poised to receive increased governmental support for research and development initiatives, potentially accelerating advancements in chip technology. This infusion of capital and oversight may lead to a more robust supply chain strategy, prioritizing domestic manufacturing capabilities to reduce dependency on overseas suppliers.

Industry analysts suggest the investment could also trigger shifts in market dynamics, including:

- Enhanced collaboration between Intel and government entities on national security projects

- Greater emphasis on sustainable and resilient manufacturing processes

- Heightened competition with key rivals such as TSMC and Samsung, driven by bolstered funding and innovation

| Intel Business Aspect | Potential Change | Market Impact |

|---|---|---|

| R&D Investment | Increase by 25% | Faster tech innovation |

| Manufacturing Footprint | Expand U.S.-based facilities | Reduced supply chain risk |

| Global Market Share | Projected growth (+5%) | Stronger competitive positioning |

Expert Recommendations for Navigating Regulatory and Economic Challenges Post-Investment

Industry experts emphasize the importance of vigilant regulatory compliance and strategic economic planning following the government’s equity acquisition. Investors and company executives must navigate an increasingly complex landscape shaped by evolving federal policies and heightened scrutiny. Ensuring transparency in reporting and proactively addressing potential antitrust concerns can mitigate regulatory risks that may otherwise disrupt corporate operations or influence shareholder confidence.

Moreover, adapting to economic fluctuations amid geopolitical tensions requires diversified investment and robust scenario planning. Experts recommend focusing on:

- Maintaining agile supply chains to counteract global disruptions.

- Leveraging government partnerships to enhance innovation while complying with national security mandates.

- Monitoring macroeconomic indicators to anticipate shifts in demand or capital costs.

- Engaging with policy makers to contribute to future regulatory frameworks.

| Challenge | Recommended Action | Expected Benefit |

|---|---|---|

| Regulatory Oversight | Establish Compliance Task Forces | Minimized legal risk and smoother audits |

| Economic Volatility | Implement Dynamic Budget Forecasting | Enhanced financial resilience |

| Geopolitical Risks | Strengthen Supply Chain Redundancy | Reduced disruption impact |

In Summary

The U.S. government’s acquisition of a 10% stake in Intel marks a significant move in the ongoing effort to bolster domestic semiconductor manufacturing and reduce reliance on foreign supply chains. As the geopolitical and economic stakes in the technology sector continue to rise, this investment reflects a strategic push to secure America’s position in critical industries. Former President Donald Trump’s comments on the development add a layer of political intrigue to the unfolding story. The full implications of this stake acquisition will become clearer as Intel and the U.S. government navigate the path forward in an increasingly competitive global tech landscape.