Despite years of conflict and mounting sanctions, the United States and Europe continue to engage in billions of dollarsŌĆÖ worth of trade with Russia. This ongoing economic interaction highlights the complex and often contradictory nature of international relations in the face of war. As global powers navigate the challenges of diplomacy, security, and commerce, the persistence of substantial business ties with Moscow raises critical questions about the effectiveness of sanctions and the realities of global interdependence. CNN explores the scope and implications of this surprising continuity in transatlantic-Russian economic relations.

US and Europe Maintain Substantial Trade Flows with Russia Amid Conflict

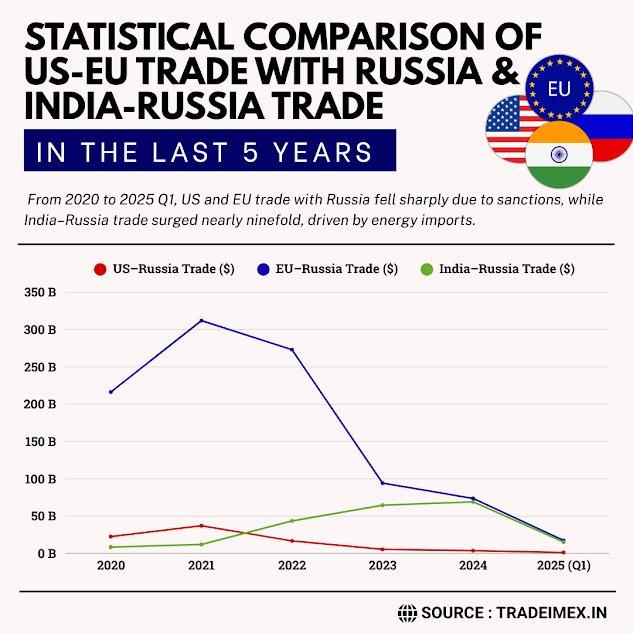

Despite ongoing sanctions and geopolitical tensions, trade between Russia and Western powers continues at a noteworthy scale. Both the US and Europe have maintained billions of dollars in imports and exports with Russia, particularly in sectors such as energy, agriculture, and technology components. This persistent exchange underscores the complexity of disentangling economic ties even amid prolonged conflict, where strategic dependencies and market demands often outweigh political stances.

Key trade categories include:

- Energy products, including oil and natural gas

- Agricultural commodities like grains and fertilizers

- Industrial machinery and technology parts

| Region | Trade Value (2023, $B) | Main Export to Russia | Main Import from Russia |

|---|---|---|---|

| United States | 12.5 | Machinery | Energy products |

| European Union | 28.4 | Pharmaceuticals | Natural gas |

Economic Implications of Continued Business Ties During Wartime

Despite official sanctions and diplomatic pressure, economic activities between Western nations and Russia continue to generate billions of dollars in revenue annually. This persistence highlights a complex web of dependencies where certain industries, such as energy, raw materials, and technology components, maintain crucial supply chains that cross conflict lines. For companies within the US and Europe, the calculus involves balancing ethical considerations, legal restrictions, and financial imperatives, all while navigating an unstable geopolitical landscape.

These ongoing transactions reinforce the resilience of business networks even during times of war, with significant consequences for global markets and political leverage. The result is a paradoxical scenario where economic engagement simultaneously fuels continuity and contention. Key areas affected include:

- Energy Supplies: EuropeŌĆÖs reliance on Russian natural gas complicates efforts to impose stricter embargoes without risking energy shortages.

- Technology Transfers: Access to advanced equipment and semiconductors sustains sectors critical to both civilian infrastructure and military applications.

- Agricultural Commodities: Trade in fertilizers and grains remains vital amid global food security concerns.

| Sector | Estimated Annual Trade Value | Implication |

|---|---|---|

| Energy | $45 billion | Undermines sanctions, sustains European energy needs |

| Technology | $12 billion | Facilitates dual-use technologies |

| Agriculture | $8 billion | Supports global food market stability |

Challenges in Enforcing Sanctions and Monitoring Financial Channels

Enforcing international sanctions in today’s complex financial landscape poses intricate hurdles that extend beyond simple regulatory frameworks. Financial institutions employ a staggering array of techniques to obscure the origin and destination of funds, such as layering transactions through multiple accounts, utilizing cryptocurrencies, and exploiting jurisdictions with lax oversight. This opacity allows sanctioned entities to continue accessing critical capital and trade networks despite official restrictions. Furthermore, global banks and trading companies often face conflicting interests, balancing compliance mandates with lucrative business opportunities, which weakens the overall impact of sanction enforcement.

Real-time monitoring of financial channels remains a formidable challenge for authorities due to:

- Rapid evolution of evasion schemes that outpace regulatory adjustments

- Dependence on private sector data sharing, which varies in transparency

- Limitations in international cooperation and intelligence-sharing mechanisms

| Challenge | Impact | Example |

|---|---|---|

| Cryptocurrency anonymity | Hides transaction origins | Use of mixers and privacy coins |

| Shell companies | Disguises ownership | Front firms in neutral countries |

| Fragmented regulations | Inconsistent enforcement | Varying sanction lists across countries |

Policy Recommendations for Strengthening Trade Regulations and Accountability

To curtail the ongoing flow of billions in trade with Russia amidst sustained conflict, robust measures focused on transparency and enforcement are imperative. Governments must prioritize comprehensive monitoring systems that track not only direct imports and exports but also indirect transactions facilitated through third countries. Strengthening due diligence requirements for multinational corporations can ensure accountability at all stages of their supply chains, preventing loopholes that allow sanctioned goods to slip through. Key policy initiatives should include:

- Establishment of cross-border regulatory coalitions to share real-time trade data

- Mandatory public disclosure of corporate dealings with sanctioned entities

- Enhanced penalties for violations, including significant financial sanctions and trade restrictions

Moreover, harmonizing trade regulations between the US and Europe will amplify the impact of sanctions and provide a unified front against circumvention tactics. Below is a comparative framework outlining core elements for transatlantic cooperation designed to elevate regulatory accountability:

| Policy Area | US Focus | European Union Focus |

|---|---|---|

| Trade Monitoring | Advanced AI-driven customs tracking | Unified data-sharing platform across member states |

| Corporate Transparency | Mandatory sanction disclosures for public firms | Extended reporting for private and state-linked companies |

| Enforcement | Fast-tracked asset freezes | Joint compliance task forces |

Future Outlook

In spite of the ongoing conflict and mounting geopolitical tensions, the continued flow of billions of dollars in trade and business between Russia, the US, and Europe underscores the complexities of global economics and diplomacy. As the war persists, these economic ties highlight the challenges policymakers face in balancing strategic interests with economic realities. Moving forward, the international community will need to carefully navigate these intertwined relationships to address both security concerns and economic dependencies.