The U.S. Census Bureau has released its latest data detailing the landscape of minority-owned, veteran-owned, and women-owned businesses across the nation. These new statistics offer critical insights into the growth, distribution, and economic impact of diverse business enterprises, highlighting trends that could influence policy and market opportunities. As entrepreneurs from these distinct groups continue to shape the American economy, the updated figures from Census.gov provide an important snapshot of their contributions and challenges in today’s business environment.

Rising Trends in Minority-Owned Businesses Across the Nation

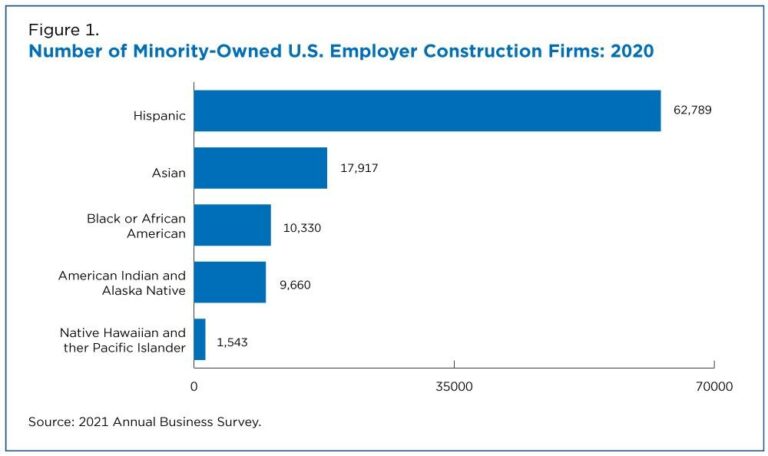

Recent census data shines a spotlight on the accelerating growth of minority-owned enterprises across diverse industries. These businesses are not only contributing significantly to the U.S. economy but are also reshaping local job markets and community development. Key sectors such as technology, healthcare, and retail have witnessed a robust surge in entrepreneurship among minority groups, propelled by increased access to capital, mentorship programs, and digital platforms breaking down traditional barriers.

Several factors are fueling this surge, including targeted government initiatives and grassroots support networks that empower budding entrepreneurs. Highlights from the latest census reveal:

- Over 15% annual increase in new minority-owned business registrations nationwide.

- Women-led minority businesses accounting for nearly 40% of growth within this segment.

- Technology startups emerging as a fast-growing niche among young minority entrepreneurs.

| Business Category | Growth Rate (2023) | Percentage Minority-Owned |

|---|---|---|

| Tech Startups | 22% | 38% |

| Healthcare Services | 18% | 32% |

| Retail and E-commerce | 15% | 29% |

Key Factors Driving Growth in Veteran-Owned Enterprises

Challenges Faced by Women-Owned Businesses in Accessing Capital

Accessing capital remains a significant hurdle for women entrepreneurs despite increasing awareness and initiatives aimed at leveling the financial playing field. Women-owned businesses often encounter stricter lending criteria, higher interest rates, and less favorable terms from traditional financial institutions. This disparity stems from a combination of factors, including persistent gender biases, limited collateral, and smaller, younger business profiles that financial entities may perceive as higher risk.

Additional challenges include:

- Less access to established investor networks compared to male counterparts.

- Underrepresentation among venture capital recipients, with only a small percentage of funding directed towards women-led startups.

- Lack of tailored financial products that match the unique needs and circumstances of women entrepreneurs.

| Barrier | Impact | Percentage Affected |

|---|---|---|

| Limited Collateral | Loan Denials/Increased Interest Rates | 65% |

| Investor Network Gaps | Reduced Venture Capital Access | 72% |

| Gender Bias | Discriminatory Lending Practices | 54% |

Policy Recommendations to Support Diverse Business Ownership

To effectively foster an inclusive economic environment, policymakers must prioritize funding initiatives that specifically target minority-owned, veteran-owned, and women-owned businesses. This includes expanding access to low-interest loans, offering tailored business development programs, and increasing government procurement opportunities. Emphasizing mentorship and networking support can help bridge knowledge gaps, enabling these entrepreneurs to scale their operations competitively within their respective markets. Equipping business owners with the right tools and resources is critical to dismantling systemic barriers and stimulating long-term growth.

Moreover, data-driven approaches should guide legislative reforms to ensure equitable representation and resource allocation. Governments at all levels can implement tax incentives and grant programs designed to encourage diverse ownership, while promoting transparency through regular, public reporting on progress. Below is a snapshot of recommended policy actions that can accelerate equitable business ownership:

| Policy Action | Intended Impact | Target Group |

|---|---|---|

| Low-interest Loan Programs | Increase capital access | Minority & Women-Owned |

| Government Contract Set-Asides | Boost market participation | Veteran-Owned |

| Business Mentorship Networks | Enhance skills & connections | All Groups |

| Data Transparency Mandates | Inform policy adjustments | Policymakers & Public |

The Conclusion

As the latest Census data sheds new light on the landscape of minority-owned, veteran-owned, and women-owned businesses, it underscores both the progress made and the challenges that remain. These detailed insights offer valuable guidance for policymakers, industry leaders, and community advocates aiming to foster a more inclusive and equitable economic environment. Moving forward, continued monitoring and support will be essential to ensure that these vital segments of the American economy not only survive but thrive in the years ahead.