The United States has expanded its tariff regime by adding 407 imported steel and aluminum products to its list of targeted goods, according to a recent report by Korea JoongAng Daily. This move aims to further protect domestic industries amid ongoing global trade tensions and concerns over unfair competition. The expanded tariffs are expected to have significant implications for international trade, particularly affecting exporters and supply chains linked to the steel and aluminum sectors.

U.S. Expands Tariff List to Include Additional Imported Steel and Aluminum Products

In a significant move to protect domestic industries, the U.S. government has broadened its existing tariff list, now targeting an additional 407 steel and aluminum products. This expansion affects a wide array of imported goods, signaling heightened tensions in international trade relations, particularly with major exporting countries. The adjustment aims to curb what the administration describes as unfair trade practices while fostering growth within the U.S. manufacturing sector.

The updated tariff list encompasses diverse products from raw materials to finished goods, including:

- Specialty steel tubes and pipes

- Aluminum sheets and coils

- Steel wire rods

- Aluminum structural parts

- Stainless steel bars and rods

| Product Category | Previous Tariff Status | New Tariff Rate |

|---|---|---|

| Steel Pipes | No Tariff | 15% |

| Aluminum Sheets | 5% | 20% |

| Wire Rods | No Tariff | 10% |

| Structural Parts | 3% | 18% |

Impact on Global Supply Chains and Market Prices for Steel and Aluminum

The recent expansion of tariffs on 407 imported steel and aluminum products by the U.S. is set to reverberate across global supply chains. Manufacturers worldwide that rely on these raw materials face disruptions from increased costs and delayed shipments, prompting a ripple effect through various industries, from automotive to construction. This protectionist move is likely to exacerbate existing bottlenecks, forcing many suppliers to reconsider their sourcing strategies and accelerate diversification efforts away from American markets.

Market prices for steel and aluminum are expected to experience upward pressure as import volumes decline, with several emerging trends to watch:

- Price volatility: Fluctuations in supply could lead to sharper price swings, impacting financial planning for businesses.

- Regional realignments: Countries may strengthen trade ties within localized networks to mitigate tariff impacts.

- Cost pass-through: Increased tariffs will likely be passed down to end consumers, influencing product pricing globally.

| Impact Area | Expected Outcome | Stakeholders Affected |

|---|---|---|

| Supply Chain Delays | Longer lead times and higher logistics costs | Manufacturers, distributors |

| Price Inflation | Steel and aluminum prices up by 10-15% | Consumers, end-product industries |

| Trade Diversification | Shift to alternative regional suppliers | Exporters, importers |

Response from Korean Exporters and Implications for Trade Relations

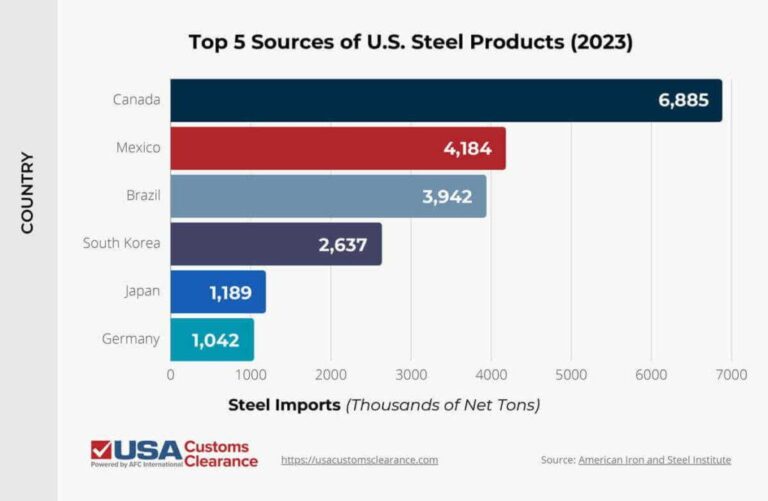

South Korean steel and aluminum exporters have expressed sharp concerns over the recent U.S. decision to expand tariff coverage to 407 additional imported products. Industry leaders argue the move threatens the competitiveness of Korean manufacturers, many of whom have already been adjusting to ongoing trade barriers in key markets. Executives from major exporters stressed the need for swift diplomatic engagement, emphasizing that sustained tariffs could disrupt longstanding supply chains and delay contract fulfillments with American partners.

Key Korean industry responses include:

- Calls for intensified government-to-government dialogue to seek exemptions or tariff relief

- Accelerated diversification of export destinations, focusing on Southeast Asia and Europe

- Investment in value-added product lines less vulnerable to tariff classification

The implications for bilateral trade relations appear multifaceted. While the tariffs aim to protect domestic U.S. industries, Korean exporters warn they risk provoking retaliatory measures or prolonged trade disputes. The situation underscores a broader challenge in U.S.-Korea economic ties: balancing national industrial policies without undermining the strategic alliance and free trade commitments critical to both economies.

| Impact Area | Short-Term Effect | Long-Term Implication |

|---|---|---|

| Export Volume | Potential decline by 10-15% | Realignment to non-U.S. markets |

| Supplier Relations | Disrupted contracts | Shift towards local sourcing in U.S. |

| Diplomatic Engagement | Heightened negotiations | New trade frameworks or agreements |

Strategies for Korean Manufacturers to Navigate Increased Tariff Barriers

With the recent expansion of U.S. tariffs to include 407 additional steel and aluminum products, Korean manufacturers are compelled to adopt multidimensional approaches to sustain their market presence. One key strategy involves diversifying export destinations to reduce over-reliance on the American market. By exploring emerging markets in Southeast Asia and Europe, companies can mitigate tariff impacts and leverage trade agreements that offer lower barriers. Simultaneously, investing in innovation to develop value-added products that meet higher standards of quality and customization can help Korean exporters remain competitive despite elevated costs imposed by tariffs.

Domestic partnerships and supply chain optimization are also vital tools in navigating the new trade landscape. Korean manufacturers are increasingly focused on:

- Enhancing raw material sourcing from tariff-exempt countries to lower input costs

- Implementing advanced manufacturing technologies for improved operational efficiency

- Strengthening collaboration with local suppliers to shorten lead times and reduce logistics expenses

These proactive measures not only soften the immediate shock of increased tariffs but also position Korean steel and aluminum producers for sustainable growth amid evolving global trade dynamics.

Future Outlook

As the United States expands its tariff coverage to include an additional 407 imported steel and aluminum products, the move signals heightened trade tensions and a more protectionist stance aimed at bolstering domestic industries. The latest tariffs are expected to impact global supply chains and could lead to retaliatory measures from affected trading partners. Industry stakeholders and policymakers will be closely watching developments as negotiations and economic repercussions unfold in the coming months.