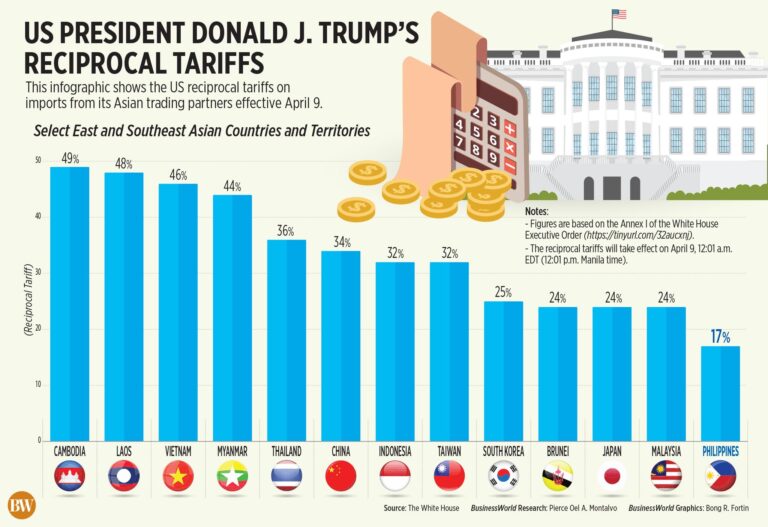

The recent announcement of new U.S. tariffs targeting imports from the Philippines has sparked concern among Taiwanese investors, who may now reconsider their investment strategies in the region. As Washington intensifies its trade measures, industry experts warn that these tariffs could disrupt supply chains and diminish the Philippines’ appeal as a manufacturing hub, potentially prompting Taiwanese businesses to seek alternatives elsewhere. This development highlights the evolving dynamics of U.S.-Asia trade relations and their far-reaching impact on regional investment flows.

New U.S. Tariffs on Philippines Raise Concerns Among Taiwanese Business Community

Taiwanese investors are carefully reassessing their expansion strategies following the announcement of new U.S. tariffs affecting goods imported from the Philippines. The move has stirred apprehension within Taiwan’s business community, which views the Philippines as a critical hub for manufacturing and supply chain operations in Southeast Asia. Key concerns focus on potential increases in operational costs and disruptions to trade flows, which could undermine the competitive advantage Taiwanese companies have cultivated in the region.

Industry leaders highlight several potential impacts stemming from the tariffs, including:

- Rising production expenses due to increased import taxes.

- Shifts in regional manufacturing hubs as firms reconsider alternative locations.

- Delays in supply chain timelines triggered by stricter customs enforcement.

| Factor | Potential Impact |

|---|---|

| Tariff Rate Increase | Up to 15% added cost on exports |

| Investor Confidence | Decreased due to market uncertainty |

| Supply Chain Diversification | Accelerated shift towards Vietnam and Indonesia |

Economic Impact on Philippine Manufacturing and Export Sectors

The newly imposed U.S. tariffs targeting Philippine exports have raised significant concerns among local manufacturers, who fear a ripple effect across the entire value chain. These measures are expected to increase production costs, reduce profit margins, and ultimately make Philippine goods less competitive in the global market. For the export-driven sectors, especially electronics and semiconductors, this may result in downsizing and delayed expansion plans, putting the country’s manufacturing growth at risk.

Taiwanese investors, who have been pivotal in driving technological advancements and capital inflows, are reportedly reconsidering their investments amid uncertain trade conditions. Their hesitation stems from fears of diminished returns and supply chain disruptions. Key factors influencing this shift include:

- Increased operational expenses due to tariff-induced costs

- Potential relocation of manufacturing facilities to tariff-free countries

- Volatility in export demand from the U.S. market

| Sector | Impact | Projection |

|---|---|---|

| Electronics | High tariff exposure | -8% export growth |

| Textiles | Moderate effect | -3% export growth |

| Semiconductors | Severe disruption | -10% export volume |

| Automotive parts | Minor impact | 0% to +1% growth |

Taiwanese Investors Rethink Strategies Amid Heightened Trade Barriers

In light of the newly imposed U.S. tariffs targeting imports from the Philippines, Taiwanese investors are recalibrating their regional strategies to mitigate potential financial setbacks. The tariffs, primarily aimed at Philippine-manufactured electronic components, pose a significant challenge for Taiwanese firms that have increasingly relied on the Philippines as a manufacturing and assembly hub. Industry insiders suggest a pivot towards alternative Southeast Asian markets or a renewed focus on domestic production capacities to circumvent these amplified trade costs. The resulting uncertainty has already sparked discussions among multinational enterprises about supply chain diversification and risk management.

Key considerations emerging in strategic discussions include:

- Cost implications: Higher tariffs threaten profit margins on goods routed through the Philippines.

- Supply chain agility: Emphasizing flexible supplier networks to reduce dependence on any single geographic source.

- Regulatory landscape: Navigating evolving trade policies requires enhanced compliance and market intelligence efforts.

To illustrate the shifting preferences within Taiwanese investment flows, the following table summarizes the comparative attractiveness of select ASEAN countries before and after the tariff announcement:

| Country | Pre-Tariff Investment Appeal | Post-Tariff Outlook |

|---|---|---|

| Philippines | High | Moderate |

| Vietnam | Moderate | High |

| Indonesia | Low | Moderate |

| Malaysia | Moderate | Moderate |

Policy Recommendations for Mitigating Investor Hesitation and Enhancing Bilateral Relations

To address the potential chill in Taiwanese investment caused by the recently imposed U.S. tariffs on the Philippines, policymakers should prioritize measures that rebuild investor confidence and streamline economic cooperation. Targeted incentives such as tax breaks, simplified regulatory processes, and guaranteed investment protections could provide immediate relief. At the same time, enhancing transparency in trade negotiations and establishing clear communication channels between Taiwan, the U.S., and the Philippines would help mitigate misunderstandings and promote a stable business environment.

Furthermore, fostering closer bilateral relations through multifaceted strategies can create a resilient framework against external economic shocks. Considerations include:

- Joint economic forums to identify sector-specific opportunities and challenges

- Investment facilitation offices dedicated to guiding Taiwanese investors navigating Philippine policies

- Collaborative infrastructure projects to boost regional connectivity and supply chain efficiency

| Policy Area | Recommendation | Expected Impact |

|---|---|---|

| Trade Transparency | Regular trilateral dialogue | Reduced policy uncertainty |

| Investor Support | One-stop assistance centers | Smoother investment execution |

| Infrastructure | Cross-border projects on logistics | Enhanced trade flow efficiency |

Final Thoughts

As the U.S. moves forward with the implementation of new tariffs on the Philippines, industry watchers and investors alike will be closely monitoring the potential ripple effects across the region. Taiwanese investors, who have been eyeing opportunities in the Philippine market, may adopt a more cautious stance amid concerns over increased costs and market uncertainties. The unfolding dynamics underscore the delicate balance of trade relations in the Asia-Pacific, where economic policies continue to shape investment flows and regional cooperation. Further developments in U.S. trade policy will be critical in determining the future landscape for Filipino industries and their international partners.