The United States has imposed a series of stringent new sanctions targeting IranŌĆÖs shipping network, escalating pressure on TehranŌĆÖs maritime activities amid ongoing geopolitical tensions. The latest measures, announced by Washington, aim to disrupt the flow of goods connected to IranŌĆÖs controversial sectors, signaling a firm stance against the nationŌĆÖs alleged breaches of international regulations. This move underscores the US commitment to curbing IranŌĆÖs influence and enforcing compliance with global trade and security norms.

US Targets Iranian Shipping Network in Latest Sanctions Effort

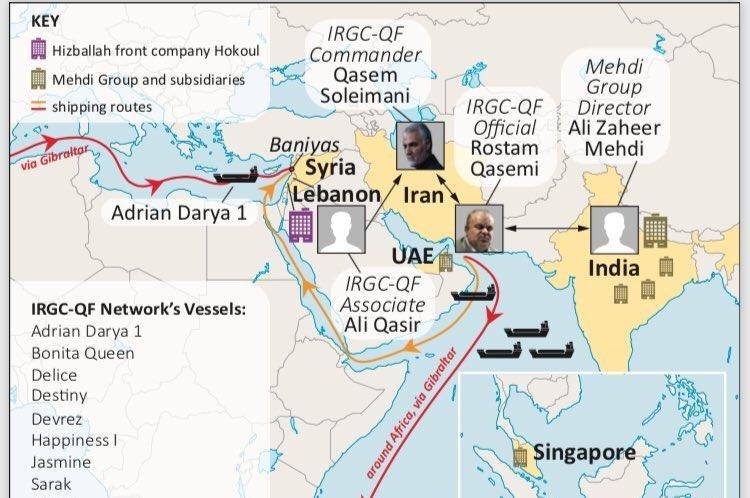

In a strategic move to curb TehranŌĆÖs influence on global maritime commerce, the United States has imposed a fresh round of sanctions targeting a key Iranian shipping network. This crackdown focuses on a web of vessels and companies alleged to facilitate IranŌĆÖs military and commercial trade under the guise of legitimate operations. By freezing assets and restricting access to international banking systems, the US aims to choke off resources that bolster IranŌĆÖs regional activities and undermine international security frameworks.

Key components of the sanctions include:

- Designation of several shipping companies linked to Iran’s IRGC (Islamic Revolutionary Guard Corps)

- Blacklisting of vessels involved in covert transport routes

- Travel bans and financial restrictions on top executives in the network

- Enhanced monitoring of maritime cargo linked to Tehran

| Entity | Status | Sanction Impact |

|---|---|---|

| Azar Shipping Co. | Designated | Asset freeze, trade restrictions |

| Mariner Transport Inc. | Blacklisted | Prohibited banking access |

| Vessel “Sepahan” | Impounded | Seizure under international law |

Impact on Global Maritime Trade and Regional Stability

The newly imposed sanctions target a critical web of Iranian maritime assets, signaling a pronounced effort to disrupt TehranŌĆÖs influence over strategic shipping lanes. This move is expected to cause ripple effects across global maritime trade, particularly in regions reliant on uninterrupted supply chains that pass through the Persian Gulf and adjacent waters. Shipping companies worldwide may face increased scrutiny and operational hurdles, potentially leading to higher insurance premiums and rerouting expenses. The resulting logistical uncertainties could elevate costs for global exporters and importers, amplifying tensions in already volatile markets.

Analysts warn of heightened geopolitical ramifications, notably:

- Destabilization risks in the Middle East maritime corridors

- Potential tightening of naval patrols and increased military presence

- Disruption to key energy exports impacting oil prices

- Strengthening of alliances among regional players responding to Bay of Bengal and Gulf tensions

| Region | Impact Level | Trade Dependency |

|---|---|---|

| Persian Gulf | High | Oil & Gas Exports |

| South Asia | Medium | Industrial Goods |

| East Africa | Low | Consumer Products |

Analysis of Economic and Diplomatic Consequences for Iran

The newly imposed sanctions are expected to significantly disrupt IranŌĆÖs maritime trade networks, further straining its economy already burdened by inflation and currency devaluation. Key sectors such as oil exports and non-oil trade corridors face heightened operational challenges, as international entities may increasingly hesitate to engage with Iranian shipping companies. The ripple effects are likely to manifest in reduced foreign investment and limited access to critical import goods, intensifying domestic economic pressures.

On the diplomatic front, Tehran may experience increased isolation as global partners align closer with U.S. policies. The sanctions could provoke a recalibration in regional alliances, particularly with countries that have economic stakes in Iranian trade routes. The pressure may also incentivize Iran to deepen strategic partnerships with non-Western powers, potentially shifting geopolitical dynamics in the Middle East.

| Impact Area | Short-Term Effects | Potential Long-Term Outcomes |

|---|---|---|

| Economic |

|

|

| Diplomatic |

|

|

Strategic Recommendations for Businesses Navigating New Sanctions

Businesses currently engaged or considering partnerships tied to Iranian shipping routes must exercise heightened due diligence. This involves thoroughly assessing compliance frameworks to mitigate exposure to the new sanctions regime. Leveraging advanced due diligence tools and consulting legal experts specialized in international trade law will be crucial. Companies should also enhance their internal training programs, ensuring all relevant staff are updated about evolving sanction parameters and potential red flags surrounding counterparties.

To adapt effectively, firms should prioritize a multi-layered approach that includes:

- Real-time monitoring: Implement transaction tracking systems that automatically flag suspicious activities linked to sanctioned entities.

- Alternative logistics planning: Explore diversified shipping routes and partners to avoid operational disruptions.

- Transparent communication: Maintain open dialogue with financial institutions and regulatory bodies to ensure transactional clarity.

| Recommended Action | Key Benefit |

|---|---|

| Implement enhanced screening tools | Reduced risk of inadvertent violations |

| Diversify operational partners | Ensure business continuity amidst sanctions |

| Invest in employee sanctions training | Enhanced compliance and risk awareness |

The Way Forward

The latest sanctions imposed by the United States mark a significant escalation in efforts to disrupt Iran’s shipping network, aiming to curb activities that Washington deems destabilizing to regional and global security. As tensions persist, these measures underscore the ongoing geopolitical complexities and the challenges faced by international trade and diplomacy. Observers will be closely watching how Iran responds and the wider implications for maritime commerce in the coming months.