A recent report from The Motley Fool sheds light on the financial realities facing American households, revealing that the average monthly expenses have reached $6,440. This figure highlights the growing cost of living amid ongoing economic challenges, including inflation and shifting consumer habits. As families navigate rising prices for essentials such as housing, food, and healthcare, understanding these expenses provides crucial insight into the current state of household budgets across the United States.

American Households Face Rising Cost of Living Pressure

As inflation continues its upward trajectory, American families are grappling with a sharp increase in monthly expenses, now averaging $6,440. Key drivers include soaring housing costs, rising food prices, and escalating healthcare expenses, which together consume a substantial portion of household income. Many households report tightening budgets to manage utility bills, transportation, and education fees, creating a ripple effect that pressures discretionary spending and long-term savings.

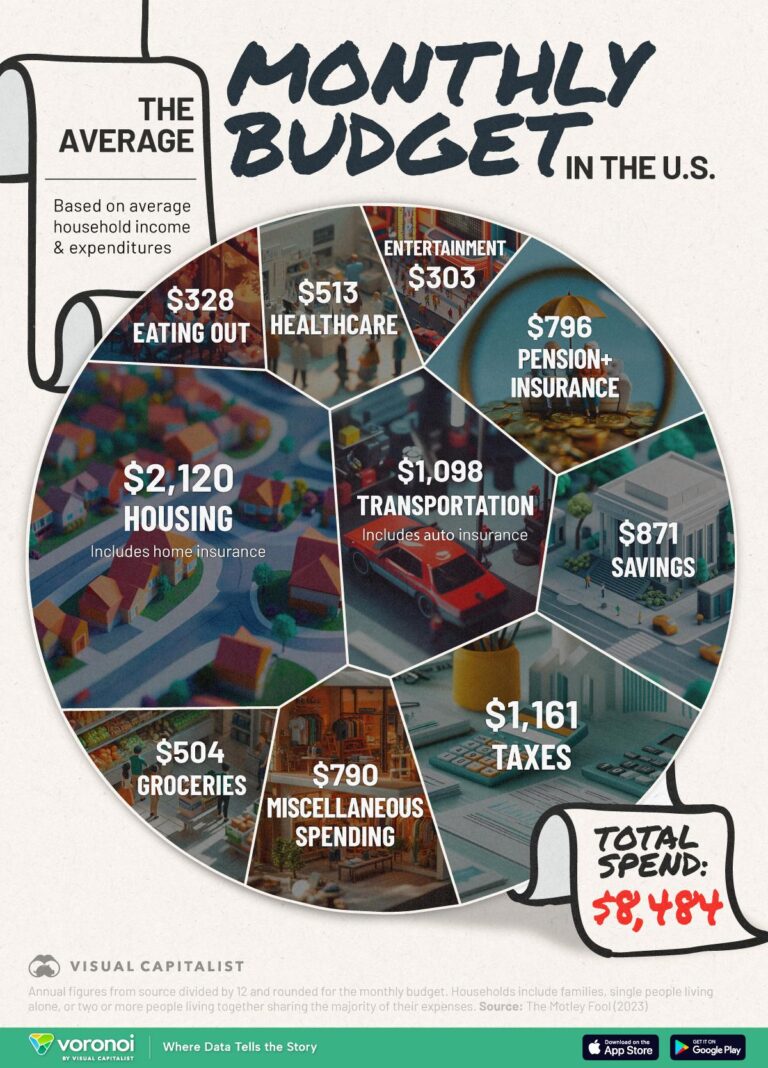

Breaking down the average monthly spending reveals the most significant burdens:

- Housing: $2,100 ŌĆō Rent and mortgage payments continue to climb amid limited housing supply.

- Food and Groceries: $780 ŌĆō Supply chain disruptions and increased production costs inflate grocery bills.

- Healthcare: $650 ŌĆō Premiums, medications, and out-of-pocket expenses are steadily rising.

- Transportation: $540 ŌĆō Fuel price volatility and maintenance costs hit family budgets hard.

- Utilities and Services: $410 ŌĆō Electricity, water, and internet costs add up quickly.

| Category | Average Monthly Cost |

|---|---|

| Housing | $2,100 |

| Food and Groceries | $780 |

| Healthcare | $650 |

| Transportation | $540 |

| Utilities and Services | $410 |

Breaking Down Monthly Expenses Across Key Categories

Examining the typical American household’s budget reveals that housing remains the most significant monthly expense, often consuming nearly one-third of total spending. This category includes rent or mortgage payments, property taxes, and utilities, which together form a substantial financial commitment for families nationwide. Following closely are transportation costs, encompassing car payments, fuel, and maintenance, reflecting the countryŌĆÖs reliance on personal vehicles for daily commuting and travel.

Food and healthcare also command a large share of the monthly outlay. Grocery bills and dining expenses reflect changing consumer habits and inflationary pressures, while healthcare costs continue to rise due to increasing insurance premiums and out-of-pocket payments. Below is a snapshot of average spending across essential categories:

| Category | Average Monthly Spend ($) | Percentage of Total |

|---|---|---|

| Housing | 1,930 | 30% |

| Transportation | 880 | 14% |

| Food | 730 | 11% |

| Healthcare | 550 | 9% |

| Entertainment | 400 | 6% |

| Utilities & Other | 950 | 15% |

Strategies for Managing Household Budgets Effectively

To maintain financial stability within the average American household budget ŌĆö which stands at approximately $6,440 monthly ŌĆö it is essential to adopt a disciplined approach to spending. Start by creating a detailed budget that categorizes all expenditures, distinguishing between fixed costs like rent or mortgage payments, and variable expenses such as dining out or entertainment. Utilizing digital tools or apps designed for budgeting can provide real-time insights and track spending habits effectively, allowing families to adjust as necessary and prevent financial leaks.

Implementing simple yet impactful strategies can dramatically improve money management. Consider these key practices for effective household budgeting:

- Prioritize essentials: Focus spending on necessities before discretionary items to handle urgent financial obligations.

- Set savings goals: Allocate a fixed percentage of income towards emergency funds or retirement to build financial security.

- Review monthly statements: Regular audits can identify subscription services or utilities that may no longer be needed or could be optimized.

| Expense Category | Average Monthly Cost | Suggested Budget Cap |

|---|---|---|

| Housing | $1,800 | $1,900 |

| Food | $700 | $650 |

| Transportation | $550 | $500 |

| Utilities & Bills | $350 | $300 |

| Entertainment | $250 | $200 |

Expert Tips for Reducing Monthly Spending Without Sacrifices

Reducing your monthly expenses doesnŌĆÖt mean you have to cut back on the essentials that bring comfort and convenience. Focus on optimizing recurring costs by analyzing subscriptions and memberships. Many households overlook the potential savings by paying for unused or underused services such as streaming platforms, gym memberships, or premium app versions. Instead, opt for bundled services when possible or switch to annual payment plans for discounts. Additionally, smart grocery shopping ŌĆö including meal planning, leveraging store loyalty programs, and buying seasonal produce ŌĆö can significantly lower your food bills without sacrificing quality or nutrition.

Another strategy is to enhance your homeŌĆÖs energy efficiency. Simple upgrades like LED lighting, programmable thermostats, and sealing drafts can reduce utility bills noticeably. Furthermore, negotiating bills with service providers, such as cable, internet, and insurance companies, can unlock discounts and better rates. HereŌĆÖs a quick guide to easy adjustments you can implement:

- Review and cancel unused subscriptions monthly

- Plan meals around sales and seasonal ingredients

- Use energy-efficient appliances and smart devices

- Switch providers or negotiate for better rates

- Automate bill payments to avoid late fees

| Expense Category | Common Savings Tip | Estimated Monthly Savings |

|---|---|---|

| Streaming Services | Consolidate subscriptions | $15 – $30 |

| Groceries | Meal planning & Couponing | $50 – $100 |

| Utilities | Energy-efficient upgrades | $20 – $50 |

| Phone & Internet | Negotiate rates | $10 – $40 |

Future Outlook

In summary, the recent analysis from The Motley Fool sheds important light on the financial realities facing American households today, with average monthly expenses reaching $6,440. This comprehensive overview underscores the diverse costs that impact household budgets, from housing and utilities to food and transportation. As economic conditions continue to evolve, understanding these expense patterns is crucial for policymakers, consumers, and financial planners alike. Moving forward, ongoing monitoring of spending trends will be essential to addressing affordability challenges and shaping economic strategies that support American families.