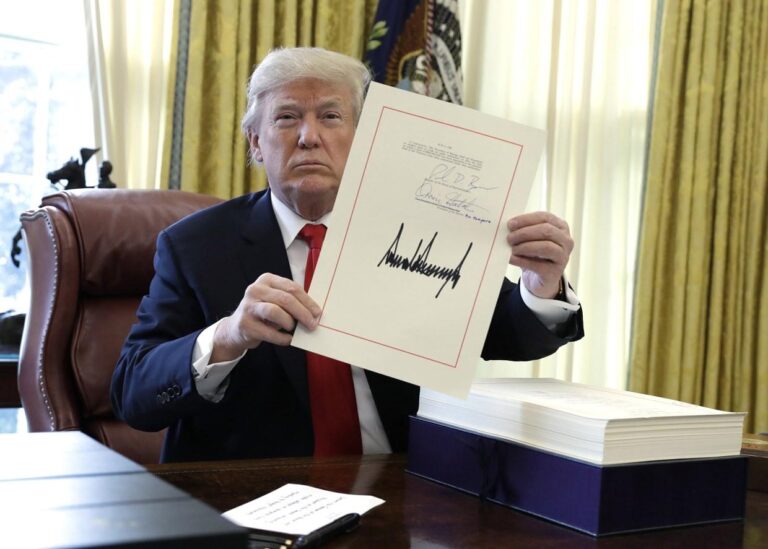

Former President Donald Trump has unveiled a major tax bill that promises to reshape key aspects of the U.S. tax code. As debates intensify over its potential impact on individuals, businesses, and the broader economy, understanding the core components of this legislation is crucial. HereŌĆÖs what you need to know about the provisions, implications, and the ongoing political response to TrumpŌĆÖs latest tax proposal.

Key Provisions Shaping Corporate Tax Rates and Incentives

The legislation introduces significant changes designed to reshape the corporate tax landscape. One of the cornerstone elements is the permanent reduction of the corporate tax rate from 21% to 17%, aimed at fostering investment and boosting domestic competitiveness. Alongside rate adjustments, the bill rolls out new credits to incentivize clean energy investments and technology innovation, signaling a strategic pivot toward sustainable economic growth. Businesses investing in renewable energy equipment may now claim a tax credit of up to 30%, a substantial boost compared to previous incentives.

In addition to rate cuts and credits, the bill redefines depreciation schedules, allowing accelerated write-offs for capital expenditures over a three-year period rather than the traditional five or seven years. This change intends to improve cash flow for expanding companies. The bill also eliminates the minimum tax on corporate book income, replacing it with a tiered incentive system rewarding profit reinvestment. Key provisions include:

- Lowered statutory tax rate: 17% flat rate for all corporations

- Enhanced R&D credits: 15% credit for qualified research expenses

- Clean energy incentives: Up to 30% tax credits on renewable investments

- Faster depreciation: Capital assets eligible for full write-off within 3 years

- Profit reinvestment breaks: Tax deductions rising incrementally with reinvested earnings

| Provision | Previous Rate/Policy | New Rule | Impact |

|---|---|---|---|

| Corporate Tax Rate | 21% | 17% | Lower tax burden, increased profits |

| Clean Energy Credit | Up to 10% | Up to 30% | Boosts green investment |

| Depreciation Period | 5-7 years | 3 years | Improved cash flow |

| R&D Credit | 10% | 15% | Encourages innovation |

Impact on Middle Class and Individual Taxpayers Explained

For the middle class and individual taxpayers, the tax bill introduces a complex mixture of relief and new challenges. Standard deductions are set to nearly double, making it easier for many households to reduce their taxable income without itemizing expenses. At the same time, the legislation eliminates personal exemptions, which previously offered a direct deduction for each taxpayer and dependent. This shift means families with multiple dependents may not see as much benefit from the increased standard deduction as initially expected.

In practical terms, this means the impact will vary widely across income levels and family sizes. Key changes include:

- Lower tax rates across most brackets, aiming to leave more money in taxpayers’ pockets.

- A limitation on state and local tax deductions to $10,000, affecting residents in high-tax states.

- Expansion of the child tax credit, increasing relief for families with young children.

- Elimination of the ACA individual mandate penalty, easing cost burdens for some.

| Taxpayer Profile | Estimated Yearly Savings | Key Benefit |

|---|---|---|

| Single, no dependents | $800 | Higher standard deduction |

| Married with 2 children | $1,200 | Expanded child tax credit |

| Homeowners, high state taxes | $400 | Limited SALT deduction |

How Small Businesses Stand to Benefit from New Tax Rules

Small businesses are positioned to gain from several key provisions embedded in the new tax legislation, designed to boost growth and ease financial pressures. Notably, the bill introduces a lower corporate tax rate, reducing the burden on small firms that file as C-corporations from 35% to 21%. This substantial cut can free up working capital, enabling reinvestment in hiring, technology, and expansion. Additionally, pass-through entitiesŌĆösuch as sole proprietorships, partnerships, and S-corporationsŌĆöstand to benefit from a 20% deduction on qualified business income, which could translate to significant savings for millions of small business owners.

Besides tax rate adjustments, the bill encourages investment by increasing the immediate expensing of capital equipment from $500,000 to $1 million. This change allows smaller enterprises to write off a larger portion of their purchases within the tax year, improving cash flow and encouraging timely upgrades. Other notable advantages include:

- Streamlined depreciation schedules to better match economic reality

- Expanded limits on deducting business interest expenses

- Enhanced incentives for research and development activities

| Benefit | Previous Rule | New Rule |

|---|---|---|

| Corporate Tax Rate | 35% | 21% |

| Pass-through Deduction | None | 20% Qualified Income Deduction |

| Expensing Limit | $500,000 | $1,000,000 |

Expert Recommendations for Navigating Changes and Maximizing Savings

Tax experts emphasize the importance of proactively assessing how the new legislation impacts your unique financial situation. Start by reviewing your income sources and potential deductions, as the bill introduces shifts in brackets and exemptions. Consider consulting a tax professional who specializes in the latest law to help identify opportunities for maximizing savings, such as accelerated depreciation for businesses or newly calculated tax credits for families. Staying ahead of deadlines for any required filings or adjustments can prevent costly penalties.

Here are essential strategies recommended by specialists to navigate the changes:

- Reevaluate Investment Portfolios: Adjust holdings to balance capital gains implications under the revised tax rates.

- Track Business Expenses Carefully: Leverage expanded deductions and avoid missed entries amid evolving rules.

- Utilize Retirement Accounts: Maximize contributions to shelters that can offer tax deferral advantages.

- Document Charitable Giving: Ensure all donations meet qualification criteria for deductions under the updated thresholds.

| Tip | Benefit | Action Timeline |

|---|---|---|

| Accelerated Depreciation | Lower taxable income for businesses | Within current fiscal year |

| Review Itemized Deductions | Maximize allowable write-offs | Before tax filing date |

| Tax-Advantaged Investments | Deferral or reduction of tax liabilities | Ongoing, annual review |

In Conclusion

In summary, TrumpŌĆÖs big tax bill introduces significant changes that could reshape the tax landscape for individuals and businesses alike. While proponents highlight potential economic growth and simplification, critics raise concerns about its impact on deficits and income inequality. As the bill moves forward, it remains crucial for taxpayers and policymakers to stay informed about its provisions and implications. USA Today will continue to provide updates and analysis as this story develops.