The latest economic outlook from Deloitte offers a comprehensive forecast for the United States in the second quarter of 2025, providing critical insights amid evolving domestic and global challenges. As markets brace for potential shifts in inflation, employment, and growth rates, Deloitte’s analysis delivers a data-driven perspective on the factors poised to shape the American economy in the coming months. This report sheds light on emerging trends, policy impacts, and sector-specific performance, equipping businesses, policymakers, and investors with the information needed to navigate an increasingly complex economic landscape.

United States Economic Growth Outlook Reveals Moderate Expansion Amid Global Uncertainties

The U.S. economy is projected to maintain a steady pace of growth throughout Q2 2025 despite persistent challenges on the global stage. Key domestic drivers include robust consumer spending, ongoing technological innovation, and resilient labor market conditions. However, experts caution that external pressures‚ÄĒsuch as fluctuating trade policies and geopolitical tensions‚ÄĒmay temper growth trajectories. Inflation rates are expected to stabilize but remain closely monitored by the Federal Reserve as part of their dual mandate to sustain employment and control price levels.

Economic indicators to watch in the coming quarter:

- Consumer Confidence Index trends

- Manufacturing output and supply chain adjustments

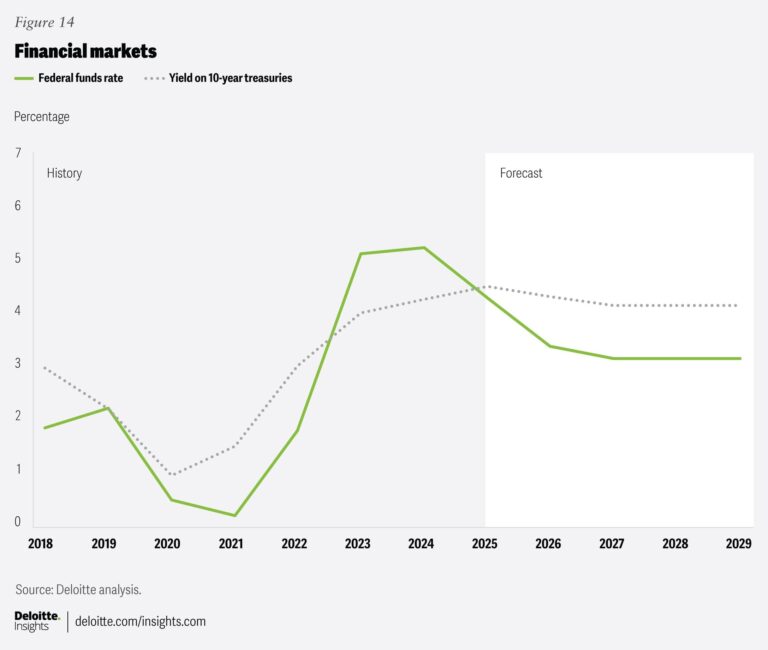

- Federal Reserve’s interest rate decisions

- Global commodity price fluctuations

| Indicator | Q1 2025 | Forecast Q2 2025 |

|---|---|---|

| GDP Growth | 1.8% | 2.1% |

| Unemployment Rate | 3.5% | 3.4% |

| Inflation Rate | 3.6% | 3.2% |

| Federal Funds Rate | 4.5% | 4.6% |

Inflation Trends and Federal Reserve Policies Set to Shape Market Dynamics

Inflation rates in the United States have shown signs of moderation after a prolonged period of volatility, yet uncertainty remains high as consumer prices continue to be influenced by lingering supply chain disruptions and fluctuating energy costs. The Federal Reserve’s monetary stance is pivotal at this juncture, balancing aggressive interest rate hikes with the risk of tipping the economy into recession. Market participants are closely watching the Fed‚Äôs signals on future rate adjustments, as their approach to achieving a sustainable inflation rate near the 2% target will dictate both investment flows and corporate earnings trajectories.

Several key factors will be instrumental in shaping market dynamics over the coming quarters:

- Interest Rate Policies: Projected to remain adaptive, with potential pauses or cuts if economic growth slows sharply.

- Inflation Expectations: Investor and consumer confidence hinge on perceived Fed credibility in controlling price pressures.

- Labor Market Resilience: A tight job market continues to support wage growth, potentially fueling inflationary pressures.

- Global Economic Conditions: External shocks, including geopolitical tensions and energy supply shifts, could disrupt domestic inflation trends.

| Quarter | Inflation Rate (%) | Fed Funds Rate (%) | Market Volatility Index (VIX) |

|---|---|---|---|

| Q1 2025 | 3.1 | 5.0 | 22 |

| Q2 2025 (Forecast) | 2.7 | 4.75 | 20 |

| Q3 2025 (Forecast) | 2.3 | 4.5 | 18 |

Labor Market Conditions Signal Gradual Improvement but Skill Gaps Persist

Recent data reflects a cautiously optimistic trajectory for the U.S. labor market, with employment figures exhibiting incremental growth across several key sectors. The unemployment rate has inched down, signaling that more Americans are finding jobs, particularly in technology, healthcare, and green energy industries. However, despite these gains, employers report persistent difficulties in filling critical roles, underscoring a widening skills mismatch that threatens to slow overall economic momentum. This divergence highlights a workforce increasingly split between available jobs and the specialized capabilities required to sustain innovation and productivity.

- Employment Growth: Steady but uneven across regions and industries

- Skill Shortages: Highest demand for digital literacy, advanced manufacturing, and healthcare expertise

- Wage Pressure: Rising salaries particularly in STEM and trades to attract qualified talent

- Reskilling Initiatives: Essential for addressing skill gaps and supporting worker transitions

Efforts to bridge these gaps are gaining traction, with both public and private sectors investing heavily in workforce development programs. Upskilling and reskilling initiatives are becoming central to labor strategy, aiming to equip workers with the competencies necessary for emerging technologies and evolving market demands. However, the pace of transformation remains uneven, suggesting that without sustained commitment and innovative training solutions, the labor market could face prolonged frictions that limit the U.S. economy’s ability to capitalize on its full potential.

| Sector | Growth Rate (Y-o-Y) | Skill Gap Intensity |

|---|---|---|

| Technology | 4.8% | High |

| Healthcare | 3.5% | Moderate |

| Manufacturing | 1.2% | High |

| Green Energy | 6.3% | Severe |

Strategic Recommendations for Businesses Navigating Supply Chain Challenges and Emerging Opportunities

To effectively manage ongoing disruptions while capitalizing on emerging market trends, businesses should prioritize robust risk assessment frameworks integrated with technological innovation. Embracing advanced analytics and AI-driven supply chain visibility tools enables proactive identification of potential bottlenecks and demand fluctuations. Moreover, diversification of supplier networks‚ÄĒanchored in both domestic and international markets‚ÄĒcan buffer against geopolitical uncertainties and raw material scarcity. Companies that adopt agile procurement strategies and foster collaborative partnerships position themselves to respond dynamically to shifting conditions and optimize inventory management.

Key strategic actions include:

- Investing in real-time data platforms for enhanced supply chain transparency

- Building multi-tiered supplier ecosystems to reduce dependency risks

- Implementing flexible logistics solutions adaptable to global disruptions

- Prioritizing sustainable and resilient sourcing practices aligned with long-term regulatory trends

| Strategy | Benefit | Implementation Timeframe |

|---|---|---|

| AI-Powered Demand Forecasting | Improved inventory accuracy | 6-12 months |

| Diversified Supplier Portfolio | Mitigates supply risk | 12-18 months |

| Collaborative Logistics Networks | Reduced transit delays | 9-15 months |

Concluding Remarks

As the second quarter of 2025 approaches, Deloitte’s latest economic forecast for the United States provides valuable insight into the challenges and opportunities that lie ahead. With a cautiously optimistic outlook tempered by potential risks such as inflationary pressures and geopolitical uncertainties, businesses and policymakers alike will need to remain vigilant and adaptable. Staying informed through expert analyses like Deloitte‚Äôs will be crucial for navigating the evolving economic landscape in the months to come.