As uncertainty clouds the future of the U.S. economy, even the Federal Reserve – the nation’s foremost economic watchdog – acknowledges its own confusion over the next steps. In a climate marked by shifting indicators, inflation concerns, and global pressures, the Fed’s cautious stance underscores the complexity facing policymakers. This article delves into the latest developments and what they reveal about the fragile state of the American economy, as captured in a recent CNN analysis.

Federal Reserve Faces Unprecedented Economic Uncertainty

The Federal Reserve is navigating an exceptionally complex economic landscape, marked by rapidly shifting variables that challenge traditional forecasting models. With inflation rates fluctuating and geopolitical tensions impacting global markets, the central bank’s usual playbook is less reliable than ever. Policymakers find themselves balancing the urgency of curbing inflation without stifling growth, a task complicated by mixed economic signals such as stubborn wage increases alongside slowing consumer spending. This uncertainty means that the Fed’s decision-making processes are under intense scrutiny, even as experts admit that clear predictions are elusive.

Key factors contributing to this uncertainty include:

- Volatile energy prices influenced by global supply disruptions

- Shifts in employment data that defy pre-pandemic patterns

- Unpredictable international trade dynamics amid ongoing tariff debates

- Rapid technological changes reshaping productivity metrics

| Economic Indicator | Current Trend | Fed Concern Level |

|---|---|---|

| Consumer Inflation | High but volatile | Critical |

| Labor Market | Strong yet uneven | High |

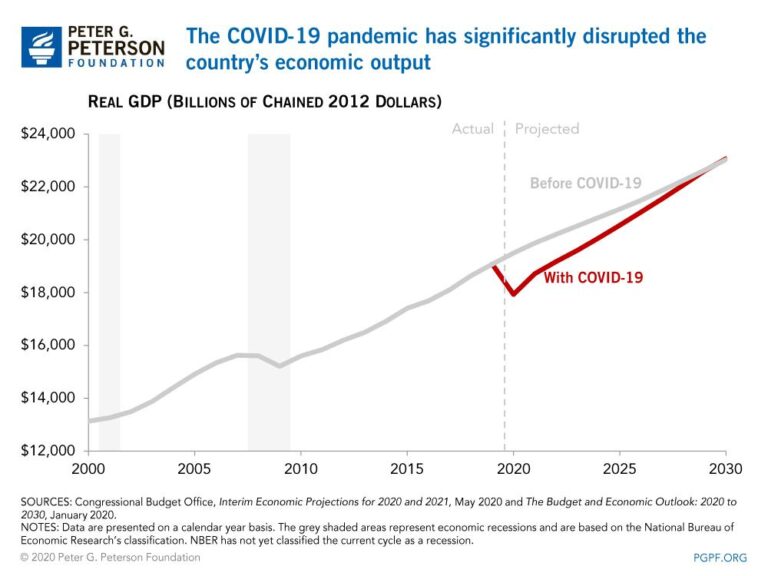

| GDP Growth | Slowing | Moderate |

| Global Trade | Unstable | Elevated |

Analyzing the Fed’s Mixed Signals on Inflation and Growth

The Federal Reserve’s recent statements reveal a complex balancing act between combating persistent inflation and sustaining economic growth. While inflation appears to be moderating, wage pressures and supply chain challenges continue to cloud the outlook. This ambiguity translates into cautious language from Fed officials, reflecting uncertainty rather than clarity about the next policy moves.

Market watchers and economists are noting several mixed indicators that complicate decision-making at the central bank:

- Core inflation remains above the Fed’s target, signaling that price stability is still out of reach.

- Labor market strength suggests ongoing consumer spending, yet rising jobless claims hint at a cooling.

- GDP growth projections have been repeatedly revised with contrasting signals on economic momentum.

| Economic Indicator | Current Status | Fed’s Stance |

|---|---|---|

| Inflation | Moderating, but still elevated | Vigilant, not complacent |

| Employment | Robust job market | Monitoring for signs of overheating |

| GDP Growth | Slower pace expected | Open to adjusting policy |

Implications of Ambiguous Fed Policies for Businesses and Consumers

Businesses are navigating a landscape fraught with unpredictability as the Fed’s signaling becomes increasingly erratic. Investment plans that once relied on clear interest rate trajectories now face delays or cancellations. Supply chain decisions and labor hiring strategies are put on hold, with companies unable to accurately forecast borrowing costs or consumer demand. The fluctuating nature of monetary policy creates an environment where risk assessment grows more complex:

- Capital expenditures stagnate as firms adopt a wait-and-see approach.

- Price-setting mechanisms become cautious, leading to potential inflation inertia.

- Credit availability tightens amid lender uncertainty over future rate moves.

Consumers, meanwhile, feel the ripple effects in everyday financial decisions. Ambiguous Fed guidance translates into mixed signals for interest rates on mortgages, auto loans, and credit cards. This uncertainty can erode buying confidence, dampen big-ticket purchases, and disrupt household budgeting. Below is a snapshot of the consumer sentiment shifts currently observed:

| Consumer Metric | Change | Implication |

|---|---|---|

| Confidence Index | -12% | Reduced discretionary spending |

| Mortgage Applications | -8% | Delayed home purchases |

| Savings Rate | +3% | Increased financial caution |

Strategic Recommendations for Navigating Economic Volatility

In an environment of unprecedented uncertainty, adaptive strategies are essential for businesses and policymakers alike. Emphasizing flexibility and resilience can make the difference between navigating successfully or getting caught off guard. Key approaches include:

- Dynamic Risk Assessment: Continuously monitor economic indicators and adjust forecasts to reflect emerging trends, avoiding reliance on outdated models.

- Diversified Portfolios: Spread investments and assets across multiple sectors and geographies to mitigate localized shocks.

- Focus on Cash Flow Management: Preserve liquidity to maintain operational agility during sudden market shifts.

Strategic planning must integrate real-time data with scenario analysis to identify potential stress points before they escalate. Below is a simplified framework to guide decision-making amid volatility:

| Strategic Focus | Recommended Actions | Expected Benefits |

|---|---|---|

| Agility | Implement fast feedback loops and agile response teams | Quick adaptation to economic shifts |

| Risk Diversification | Expand asset allocation and supply chain options | Reduced vulnerability to singular shocks |

| Liquidity Focus | Boost cash reserves and optimize receivables | Enhanced financial stability during downturns |

Concluding Remarks

As uncertainties continue to cloud the economic outlook, the Federal Reserve’s cautious approach underscores the complexity of navigating today’s financial landscape. For businesses, investors, and policymakers alike, staying informed and adaptable remains essential as the nation awaits clearer signals on the path forward. While the Fed’s deliberations highlight the challenges ahead, they also emphasize the commitment to steering the US economy toward stability amid unprecedented conditions.