The United States sports media landscape witnessed a record-breaking surge in rights expenditures, with total spending reaching an unprecedented $30.5 billion, according to a recent report by Señal News. This significant investment underscores the escalating competition among broadcasters and streaming platforms to secure premium sports content, highlighting the enduring appeal and commercial value of live sports in an increasingly digital entertainment era.

USA Sports Rights Spending Hits Record High

The sports broadcasting landscape in the United States has witnessed an unprecedented surge in investment, with spending on sports rights reaching an all-time high of $30.5 billion. This historic figure underscores the escalating value broadcasters and streaming services place on live sports content as a crucial driver of viewer engagement and subscription growth. Key players in the industry are competing fiercely to secure exclusive access to marquee events, propelling overall expenditure to new heights.

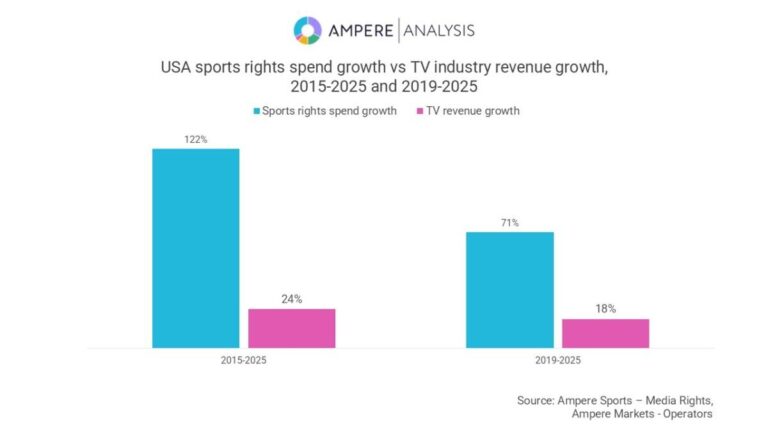

Several factors have contributed to this surge, including the expansion of digital platforms, the growing popularity of niche sports, and multi-year deals locked in by major leagues. Below are some highlights of the latest spending trends:

- Major leagues such as NFL, NBA, and MLB commanding the largest market shares

- Streaming services increasing their presence with lucrative deals to reach younger audiences

- International sports gaining traction through significant rights acquisitions

| League / Platform | Annual Spending (Billion $) | Deal Duration (Years) |

|---|---|---|

| NFL | 6.8 | 10 |

| NBA | 4.5 | 9 |

| MLB | 2.7 | 7 |

| Streaming Platforms | 8.2 | Varies |

| Others | 8.3 | Various |

Key Drivers Behind the Surge in Sports Media Investments

The dramatic increase in sports media investments is propelled by a mix of technological advancement and shifting consumer behavior. With streaming platforms expanding their reach, live sports content has become a crucial battleground for subscriber acquisition and retention. Broadcasters are eager to secure exclusive rights to top-tier leagues and tournaments, betting on the dedicated fan base’s willingness to pay premiums for uninterrupted, high-quality coverage.

Moreover, the advertising potential tied to sports media continues to attract significant capital. Brands are increasingly leveraging sports events to connect with deeply engaged audiences, leading to greater monetization opportunities. Other critical factors driving this surge include:

- Emergence of new digital distribution channels enabling wider access and higher engagement.

- Growth of sports betting partnerships adding layers of interactivity and revenue streams.

- Globalization of sports viewership expanding markets beyond traditional domestic boundaries.

| Driver | Impact | Trend |

|---|---|---|

| Streaming Platform Expansion | Greater Content Reach | Increasing |

| Ad Revenue Growth | Boosted Investments | Rising |

| Global Market Access | Diversified Audience | Growing |

Impact on Broadcasting Networks and Streaming Services

The ever-increasing investments in sports rights have significantly reshaped the landscape for both traditional broadcasting networks and emerging streaming services. Broadcasters, facing fierce competition, have allocated substantial budgets to secure exclusive rights for marquee sports events, aiming to maintain their stronghold in prime-time viewership. This spending surge is driven by the relentless pursuit to attract advertisers and maximize live audience engagement, especially in an era where real-time sports content remains one of the few programming types that commands mass simultaneous viewership.

Streaming platforms, on the other hand, are capitalizing on this trend by disrupting legacy models with more flexible and innovative content delivery. Their ability to offer personalized, on-demand access combined with interactive features appeals to younger, tech-savvy audiences. Key impacts include:

- Increased competition: Streaming services aggressively bidding for rights previously dominated by traditional broadcasters.

- Exclusive content bundles: Platforms offering multisport packages to enhance subscriber retention.

- New revenue models: Integration of targeted advertising and subscription tiers linked to sports rights acquisition.

- Global reach: Streaming breaking geographical barriers, expanding the sports fan base internationally.

| Network Type | 2023 Sports Rights Spend | Primary Audience Focus |

|---|---|---|

| Traditional Broadcasters | $18.2 billion | Mass-market, live TV viewers |

| Streaming Services | $12.3 billion | Millennials, cord-cutters, global fans |

Strategic Recommendations for Stakeholders Amid Rising Costs

To navigate the escalating costs of sports rights, stakeholders must prioritize data-driven investment strategies that balance fan engagement with sustainable spending. Media companies, leagues, and advertisers should leverage advanced analytics to identify content segments with the highest return on investment, optimizing bidding approaches in competitive rights auctions. Additionally, diversifying content distribution through digital platforms and social media can reduce reliance on traditional expensive broadcasting deals while expanding audience reach.

Collaboration across the ecosystem is vital to temper price inflation. Industry players can explore shared rights agreements or regional content pooling to distribute financial burdens. The following table illustrates a hypothetical model for cost-sharing among key stakeholders:

| Stakeholder | Contribution % | Key Benefit |

|---|---|---|

| Broadcast Networks | 40% | Exclusive live content |

| Digital Platforms | 30% | Streaming rights & flexibility |

| Sports Leagues | 20% | Revenue sharing & growth |

| Advertisers & Sponsors | 10% | Brand exposure & engagement |

Ultimately, embracing innovation—such as using blockchain for transparent rights management or AI to forecast viewer trends—will empower stakeholders to maximize value amid rising expenditures.

Closing Remarks

As the landscape of sports media continues to evolve, the staggering $30.5 billion spent on sports rights in the United States underscores the immense value and influence of live sports content. This surge reflects not only the competitive drive among broadcasters and streaming platforms but also the enduring passion of American sports fans. Moving forward, industry stakeholders will closely watch how investments in sports rights shape the future of viewership, technology integration, and revenue models across the sector.