Former President Donald Trump has renewed his criticism of Federal Reserve Chairman Jerome Powell, alleging that the central bank’s reluctance to lower interest rates is hurting the U.S. economy and costing the country a fortune. However, experts and policymakers caution that even if TrumpŌĆÖs calls to remove Powell were heeded, changing leadership at the Fed may not sufficiently address the complex challenges facing the nationŌĆÖs monetary policy. This article explores the ongoing debate over interest rates, the limits of Fed chair authority, and the broader implications for economic stability.

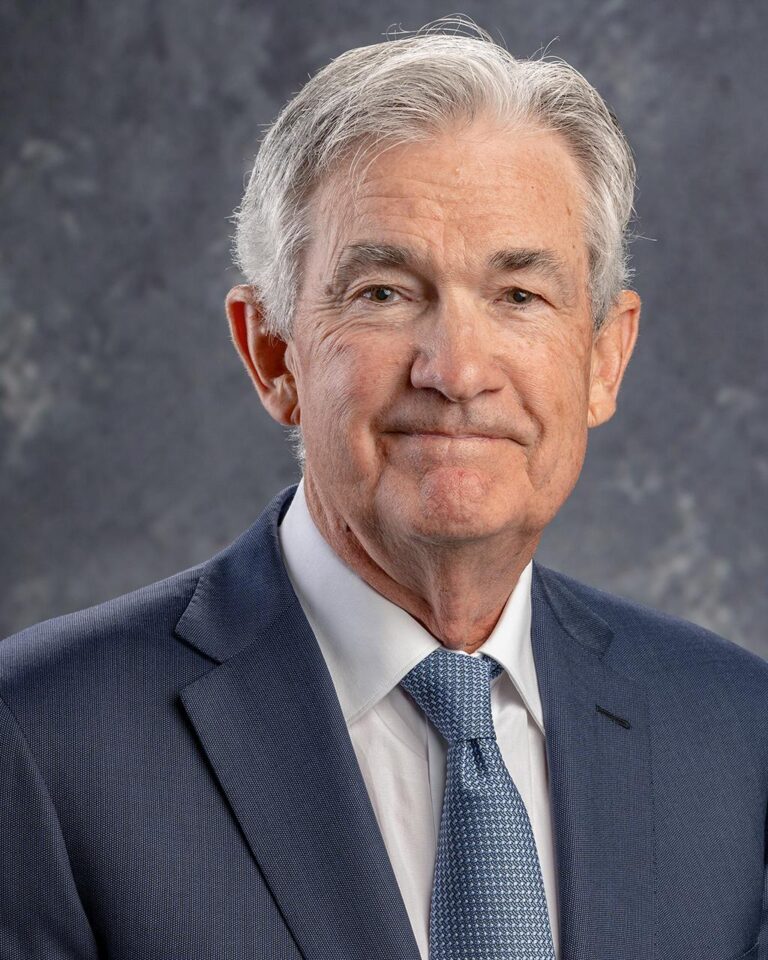

Trump Criticizes Powell for High Interest Rates and Economic Impact

Former President Donald Trump has sharply criticized Federal Reserve Chair Jerome Powell for maintaining high interest rates, claiming they are detrimental to the U.S. economy. Trump argues that Powell’s reluctance to reduce rates is “costing the country a fortune,” highlighting soaring borrowing costs for businesses and consumers alike. The former president insists that a more accommodative monetary policy is essential to spur growth and alleviate inflation pressures.

However, experts caution that simply replacing the Fed chair may not resolve the underlying challenges. The Federal Reserve operates independently to balance inflation control with employment objectives, and interest rate decisions reflect complex economic indicators. Key considerations include:

- Persistent inflationary forces despite rate hikes

- Global supply chain disruptions affecting prices

- The Fed’s dual mandate to ensure long-term economic stability

| Rate Change | Impact |

|---|---|

| Increase | Slows borrowing; cools inflation |

| Decrease | Encourages spending; may boost growth |

| Stable | Maintains current economic balance |

Economic Experts Weigh In on Risks of Political Interference at the Federal Reserve

Economic experts have expressed growing concern over the potential consequences of political pressure on the Federal Reserve’s independence. Many warn that attempts to influence monetary policy for short-term political gain could undermine the central bank’s credibility and long-term economic stability. While former President TrumpŌĆÖs criticism of Fed Chair Jerome Powell centers on the belief that lower interest rates would spur growth and bolster markets, economists argue that firing the Federal Reserve chair would not address the underlying challenges facing the U.S. economy.

Analysts emphasize the complexity of economic factors that dictate interest rate decisions, beyond political influence. They highlight key risks associated with political interference, including:

- Increased market volatility due to unpredictable policy shifts

- Reduced confidence in the FedŌĆÖs ability to manage inflation effectively

- A potential rise in long-term borrowing costs from damage to the U.S. dollarŌĆÖs reputation

| Risk | Potential Impact |

|---|---|

| Market Volatility | Higher fluctuations in stock and bond markets |

| Inflation Management | Difficulty in controlling price stability |

| Currency Confidence | Weakened U.S. dollar in global markets |

Historical Context of Fed Chair Removals and Market Reactions

Throughout U.S. history, abrupt changes in Federal Reserve leadership have sent shockwaves through financial markets, often leading to volatility and uncertainty rather than clear-cut economic improvement. For example, the 1979 dismissal of Fed Chair G. William Miller amid inflation concerns marked a pivotal moment when markets initially reacted with shock before stabilizing. Such incidents highlight a recurring theme: the reaction to a Fed Chair’s removal often reflects fear about the future direction of monetary policy rather than immediate confidence in the change itself.

Key market reactions to Fed Chair removals have included:

- Sharp sell-offs in bond markets due to speculation about interest rate shifts

- Sudden spikes in stock market volatility as investors reevaluate risk

- Increased uncertainty surrounding inflation and economic growth projections

| Fed Chair | Year Removed | Immediate Market Reaction |

|---|---|---|

| G. William Miller | 1979 | Bond sell-off, market uncertainty |

| Paul Volcker (speculated) | Early 1980s | Market volatility, higher long-term rates |

| Jerome Powell (hypothetical) | N/A | Potential volatility, uncertainty |

Strategies for Addressing Inflation Beyond Monetary Policy Adjustments

Addressing inflation demands a multifaceted approach that transcends traditional monetary policy tools. Governments and policymakers can implement fiscal measures such as targeted subsidies or tax adjustments to alleviate cost pressures on consumers without compromising economic stability. Enhancing supply chain resilience through investments in infrastructure and technology also plays a critical role, mitigating price spikes driven by logistical bottlenecks and global disruptions.

Moreover, structural reforms aimed at boosting productivity can provide long-term inflation relief. These include:

- Labor market flexibility to facilitate hiring and wage adjustments aligned with economic conditions

- Promotion of competition in key industries to prevent monopolistic price setting

- Encouraging innovation to increase efficiency and reduce costs

Such strategies require close coordination between federal agencies, industry stakeholders, and policymakers for sustainable impact.

| Strategy | Key Benefit | Potential Challenge |

|---|---|---|

| Targeted Fiscal Policies | Immediate consumer relief | Risk of budget deficits |

| Supply Chain Investment | Reduces price bottlenecks | Implementation lag |

| Labor Market Reform | Improved wage-price dynamics | Political resistance |

In Summary

As the debate over monetary policy continues to intensify, former President TrumpŌĆÖs criticism of Federal Reserve Chair Jerome Powell underscores the broader tensions surrounding the U.S. economy and interest rates. While Trump blames Powell for the economic challenges through his reluctance to lower rates, experts caution that removing the Fed chair alone is unlikely to resolve the complex issues at hand. Ultimately, the path forward will require a measured approach that balances inflation control with growth, rather than quick fixes driven by political pressures.