As global trade tensions continue to reshape international markets, an increasing number of companies are exploring expansion into the United States to mitigate the impact of escalating tariffs. In this latest report from Reuters, we examine which firms are strategically shifting their operations stateside in an effort to reduce costs and safeguard supply chains amidst ongoing trade disputes. This trend highlights a significant recalibration in corporate strategies as businesses navigate the complexities of tariffs and seek stability in a volatile economic landscape.

Companies Targeting US Market to Mitigate Impact of Rising Tariffs

Several major players across various industries are increasingly eyeing the US market as a strategic move to cushion themselves against escalating tariff pressures. Among them, prominent electronics manufacturers and automotive giants are planning to ramp up local production and establish new facilities stateside. This shift aims not only to avoid punitive import taxes but also to capitalize on the growing domestic consumer base. Companies like Samsung, Toyota, and Lego have all publicly announced expansion initiatives or considered shifting critical manufacturing operations to the US in the upcoming fiscal year.

Key areas of focus for these companies include:

- Investment in localized supply chains to reduce dependency on foreign components subject to tariffs.

- Enhancement of research and development hubs within US borders to spur innovation closer to the end market.

- Collaboration with regional logistics providers to streamline distribution and reduce costs.

| Company | Sector | US Expansion Plan | Tariff Impact Mitigation |

|---|---|---|---|

| Samsung | Electronics | New manufacturing plant in Texas | Reducing import levies by 30% |

| Toyota | Automotive | Assembly line expansion in Kentucky | Minimizing parts tariffs by 25% |

| Lego | Consumer Goods | Building distribution center in New Jersey | Streamlining logistics, cutting cost by 20% |

Sector-Specific Strategies Adopted to Navigate Trade Barriers

Manufacturing giants in the automotive and electronics sectors have taken the lead in adjusting their operational footprints amid escalating tariffs. To reduce reliance on overseas production vulnerable to trade restrictions, many are relocating parts of their supply chains closer to the US market. This strategic move includes ramping up assembly plants and forging partnerships with local suppliers, enabling quicker responsiveness to demand while minimizing tariff impact. For example, several electronics companies have increased investments in US-based R&D and component manufacturing facilities, balancing cost with reduced exposure to tariffs on imported goods.

Key approaches embraced include:

- Optimizing production networks by diversifying manufacturing locations within North America

- Investing in automation to offset higher labor costs associated with US operations

- Prioritizing goods classification and sourcing strategies to benefit from tariff exemptions and trade agreements

| Sector | Primary Strategy | Example Company | Status |

|---|---|---|---|

| Automotive | Supply chain reshoring | Ford | Expanding Kentucky plant |

| Electronics | Increased US R&D investment | Apple | Launching new component facility |

| Consumer Goods | Local supplier partnerships | Procter & Gamble | Building supplier network in US |

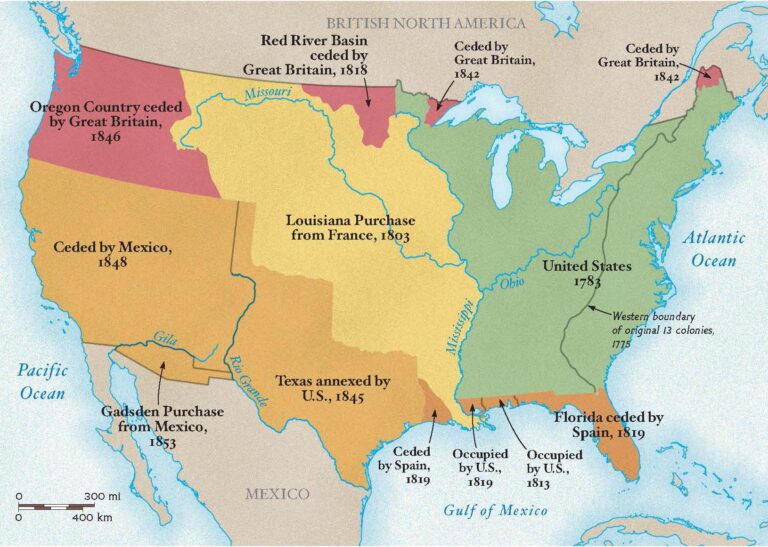

Key Regional Hubs Attracting Foreign Investment Amid Tariff Pressures

Companies facing escalating tariff costs amid ongoing trade tensions are increasingly eyeing strategic regional hubs for manufacturing and distribution. US border states like Texas and Arizona, along with key metropolitan areas such as Atlanta and Chicago, are rapidly becoming prime destinations due to their logistical advantages and business-friendly policies. These locations offer efficient access to both domestic and international markets, helping firms mitigate tariff impacts while maintaining competitive supply chains.

Key benefits attracting foreign investment include:

- Proximity to major US ports and border crossings

- Robust transportation infrastructure including highways and rail

- Access to skilled labor pools and advanced manufacturing facilities

- Incentives offered by state and local governments

| Region | Primary Industries | Proposed Investments |

|---|---|---|

| Texas | Automotive, Electronics | $1.2B in new plants |

| Arizona | Semiconductors, Aerospace | $950M expansions |

| Georgia | Logistics, Consumer Goods | $870M distribution centers |

| Illinois | Machinery, Chemicals | $720M manufacturing upgrades |

Recommendations for Businesses Considering US Expansion to Avoid Tariff Costs

To counteract the financial strain imposed by escalating tariffs, companies aiming at US expansion should prioritize strategic site selection, focusing on states with robust manufacturing incentives and access to critical logistics hubs. Emphasizing partnerships with local suppliers can also significantly reduce inbound costs and mitigate supply chain disruptions. Firms are advised to invest in thorough market research to align product offerings with regional consumer preferences, ensuring that tariff savings translate into competitive pricing and enhanced market penetration.

Key strategies include:

- Leveraging free trade zones and economic development programs

- Optimizing production lines through advanced automation technologies

- Implementing flexible supply chains that can pivot swiftly amid geopolitical shifts

- Engaging local legal and trade advisors to navigate regulatory nuances

| Strategy | Benefit | Example |

|---|---|---|

| Free Trade Zones | Reduces import/export taxes | California FTZ #202 |

| Automation | Increases efficiency, cuts labor costs | Automated assembly lines |

| Local Partnerships | Minimizes supply chain risk | Supplier relationships in Texas |

| Regulatory Guidance | Ensures compliance, avoids penalties | Engaging trade consultants |

To Conclude

As trade tensions and tariff challenges continue to reshape global supply chains, an increasing number of companies are eyeing expansion into the US market to mitigate potential fallout. While the landscape remains fluid, these strategic moves underscore the growing importance of domestic production and market proximity in navigating complex international trade dynamics. Observers will be watching closely to see how these expansions impact both the companies involved and the broader economic environment moving forward.