In recent years, an alarming surge in financial scams targeting American consumers has been traced back to foreign fraudsters exploiting vulnerabilities within the U.S. banking system. A ProPublica investigation reveals how these international scammers leverage American financial institutions to deceive victims, siphoning off billions of dollars while evading detection. This exposé sheds light on the complex tactics used by perpetrators and highlights the critical gaps in regulatory oversight that allow such schemes to flourish, underscoring the urgent need for systemic reforms to protect everyday Americans from becoming victims of cross-border financial crime.

Foreign Scammers Exploit U.S. Banking Systems to Target Americans

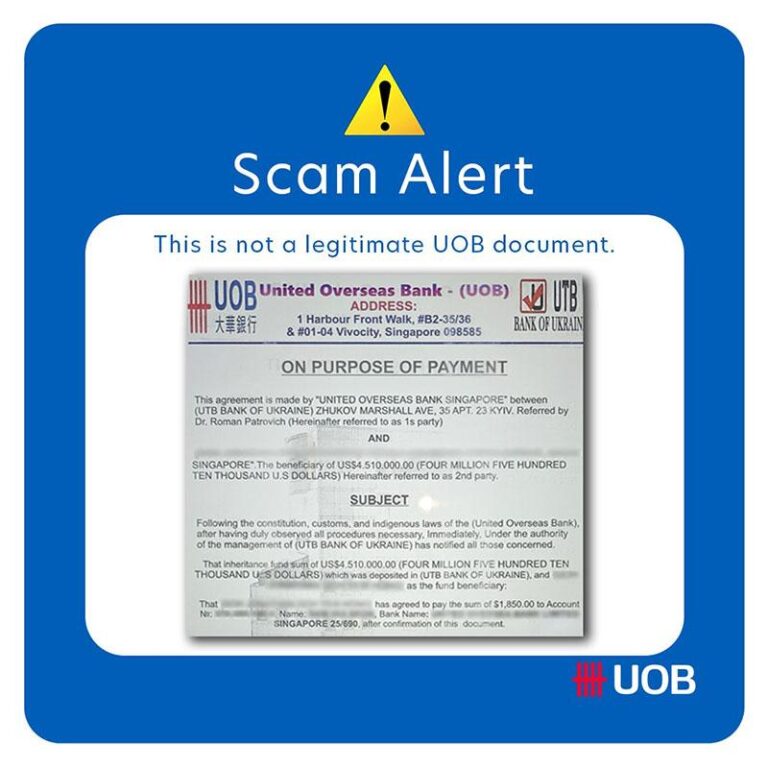

Foreign scammers have increasingly exploited vulnerabilities within the U.S. banking infrastructure to execute sophisticated fraud schemes targeting American consumers. These criminals often camouflage their activities by opening fraudulent accounts using forged documents or stolen identities, enabling them to funnel illicit gains undetected. U.S. financial institutions, despite stringent regulations, sometimes struggle to identify these fraud patterns promptly due to the ever-evolving tactics employed by overseas operators. The consequences for victims range from drained savings to long-term credit damage, with recovery often complicated by cross-border legal challenges.

Key methods used by these scammers include:

- Synthetic identity fraud – combining real and fake information to create new identities.

- Money mule networks – recruiting unwitting Americans to transfer illegal profits.

- Wire fraud and phishing scams – tricking individuals into revealing sensitive banking details.

| Scam Type | Common Tactics | Impact on Victims |

|---|---|---|

| Synthetic Identity | Fake IDs, forged credit histories | Unauthorized loans, damaged credit |

| Money Mule | Social engineering, fake job offers | Legal trouble, financial loss |

| Phishing | Email scams, fake websites | Account takeover, stolen funds |

Methods and Tactics Used by International Fraud Rings in Financial Schemes

International fraud rings have become increasingly sophisticated in exploiting the infrastructure of U.S. banks to execute their financial schemes. These groups commonly employ multi-layered money laundering techniques, using a web of shell companies and fake accounts to obscure the source and destination of illicit funds. By leveraging stolen or synthesized identities, they manage to open accounts without immediate detection, often using real people’s credit information without their knowledge. This allows them to funnel millions through legitimate banking channels, making it extraordinarily difficult for regulators to trace the activities back to the originators.

Their approach is characterized by a blend of technology and human manipulation, including:

- Phishing campaigns to harvest login credentials from unsuspecting victims.

- Exploiting regulatory loopholes in cross-border transactions to avoid scrutiny.

- Using automated transaction bursts that mimic normal banking behavior, avoiding the red flags set by anti-fraud algorithms.

| Tactic | Purpose | Typical Methods |

|---|---|---|

| Account Takeover | Gain access to legitimate accounts | Phishing, credential stuffing |

| Synthetic Identity Fraud | Create new, fake identities | Data aggregation, fake documents |

| Transaction Laundering | Obscure fund sources | Layered payment chains |

Challenges Faced by Banks and Regulators in Preventing Cross-Border Scams

Financial institutions and regulatory bodies grapple with a complex web of obstacles when attempting to stem the tide of international fraud schemes exploiting U.S. banking systems. A critical issue is the sheer sophistication of scam networks, which leverage advanced technologies such as anonymizing VPNs, synthetic identities, and layered transaction methods to obscure money trails. These factors hinder traditional due diligence efforts, leaving banks scrambling to spot red flags before substantial damage occurs.

Moreover, jurisdictional challenges significantly blunt the effectiveness of enforcement actions. Differences in regulatory frameworks across countries create loopholes that foreign scammers exploit with impunity. Regulators often face delays in information sharing and limited authority to compel cooperation from overseas entities. Below is a summary of principal challenges:

- Lack of Real-Time Cross-Border Data Sharing: Slows fraud detection and intervention.

- Fragmented Legal Frameworks: Varied anti-fraud laws hamper coordinated response.

- Limited Resources in Regulatory Bodies: Inadequate staffing and technology investments restrict investigative scope.

- Complex Money Movement Methods: Use of cryptocurrencies and layered accounts obscures origins.

| Challenge | Impact on Prevention | Potential Solutions |

|---|---|---|

| Data Silos | Delayed fraud indicators across jurisdictions | International data-sharing agreements |

| Regulatory Gaps | Inconsistent enforcement efforts | Harmonized global compliance standards |

| Resource Constraints | Investigation bottlenecks | Increased funding and tech deployment |

Strategies and Recommendations to Strengthen Protections for American Consumers

To fortify defenses against the growing threat posed by foreign scammers leveraging U.S. financial institutions, policymakers and industry leaders must pursue a multifaceted approach. Enhanced due diligence protocols are pivotal—banks should implement rigorous verification processes that cross-check customer identities against international watchlists and suspicious activity databases in real-time. Equally important is increasing transparency and accountability through mandatory reporting of high-risk transactions, enabling law enforcement agencies to trace illicit flows more efficiently.

Consumer education campaigns must be amplified to empower Americans with knowledge about evolving scam tactics, encouraging vigilance and prompt reporting of suspicious communications. Financial entities should collaborate to establish a centralized, secure platform for sharing information on emerging fraud patterns, thereby enabling proactive prevention. Below is a comparative overview of key recommendations, outlining actionable steps for stakeholders:

| Stakeholder | Strategy | Expected Outcome |

|---|---|---|

| Banks | Implement rigorous KYC and real-time fraud detection | Early identification of suspicious accounts |

| Regulators | Mandate reporting of cross-border transactions | Improved law enforcement intervention |

| Consumers | Access educational resources on scams | Increased public awareness and prevention |

| Industry Coalitions | Share intelligence on emerging threats | Coordinated response against fraud networks |

In Conclusion

As investigations continue to expose the sophisticated tactics employed by foreign scammers leveraging U.S. banks, the urgent need for stronger regulatory oversight and enhanced security measures becomes clear. Protecting American consumers requires coordinated efforts between financial institutions, law enforcement, and policymakers to close the loopholes exploited by these criminal networks. ProPublica’s reporting sheds critical light on these illicit operations, underscoring the importance of vigilance and reform in safeguarding the integrity of the nation’s banking system.