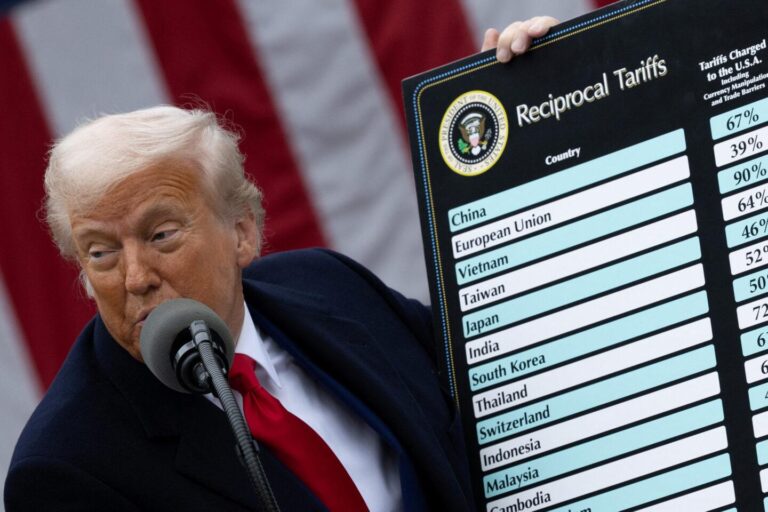

Federal Appeals Court Confirms Continuation of Trump-Era Tariffs

In a decisive legal development, a U.S. appellate court has temporarily halted a previous judgment that sought to eliminate the tariffs introduced under former President Donald Trump’s tenure. This ruling sustains the contentious import levies for the foreseeable future, thereby extending their impact on trade policies and economic conditions. The court’s stance underscores the recognition of tariffs as a tactical tool aimed at addressing trade deficits and protecting American industries from unfair foreign competition, with a particular focus on imports originating from China.

Key implications arising from this decision include:

- Continued financial burdens on importers and consumers due to sustained tariff expenses

- Ongoing disruptions and realignments within global supply networks and manufacturing sectors

- Increased uncertainty for enterprises seeking consistent trade policy environments

| Sector | Impact | Adaptive Strategy |

|---|---|---|

| Automotive | Rising costs of imported components | Shifting to alternative foreign suppliers |

| Electronics | Delays in product launches | Increasing investments in domestic production |

| Consumer Goods | Price increases passed to end-users | Implementing cost absorption and innovating products |

Repercussions for US-China Trade and Economic Projections

The appellate court’s affirmation of the tariffs has further strained the already tense trade relationship between the United States and China. These duties continue to impose significant costs on American importers and suggest a prolonged phase of economic friction between the two largest global economies. Trade experts warn that this move could stall progress toward renewed diplomatic negotiations and may trigger retaliatory tariffs or trade restrictions from China, complicating bilateral commerce.

Economic forecasts are being revised to account for the sustained trade barriers. While certain manufacturing industries might benefit from protective tariffs, consumer prices in the U.S. are projected to stay elevated, adding to inflationary pressures. The table below highlights critical economic metrics affected by the tariffs:

| Economic Metric | Pre-Tariff Level | Forecast Post-Tariff |

|---|---|---|

| Consumer Price Index (CPI) | 2.1% annual growth | 3.0% annual growth |

| Exports to China | 100% baseline | Decline to 85% |

| Manufacturing Output | Stable | 4% growth in select sectors |

| Foreign Direct Investment (FDI) | Moderate increase | Slower growth rate |

- Elevated consumer costs driven by tariff-related price increases.

- Potential slowdown in international investment flows.

- Extended uncertainty in trade talks, risking negotiation deadlocks.

How Industries Are Adjusting to Prolonged Tariff Enforcement

Following the court’s decision to prolong these tariffs, affected sectors are rapidly modifying their business models to mitigate financial impacts. Companies reliant on imported materials are intensifying efforts to diversify their supply chains, exploring alternatives outside tariff-affected regions. This strategy aims to lower costs and maintain uninterrupted production despite ongoing tariff challenges.

Key strategic adaptations include:

- Enhancing domestic manufacturing capabilities to avoid import tariffs.

- Revising supplier contracts to include tariff risk mitigation and flexible pricing terms.

- Developing innovative products and value-added services to counterbalance increased costs.

| Industry | Main Strategy | Expected Result |

|---|---|---|

| Automotive | Local sourcing of components | Reduced lead times, higher expenses |

| Technology | Expanding supplier diversity | Greater supply chain resilience |

| Retail | Refining pricing strategies | Maintained profit margins |

Policy Recommendations for Managing Prolonged Trade Tariffs

To effectively manage the extended impact of trade tariffs, businesses and policymakers should emphasize resilience through diversification and operational improvements. Suggested measures for companies include:

- Broadening sourcing beyond countries affected by tariffs to minimize risk.

- Investing in automation and cutting-edge technologies to enhance efficiency.

- Engaging proactively with regulatory agencies to anticipate regulatory changes.

- Developing contingency plans to address ongoing market volatility.

From a governmental standpoint, experts advocate for targeted support such as stimulus programs and trade facilitation efforts to aid affected industries. The following table summarizes critical policy priorities and their anticipated advantages:

| Policy Area | Recommended Action | Expected Impact |

|---|---|---|

| Export Promotion | Offering subsidized financing and tax incentives | Enhanced competitiveness in global markets |

| Supply Chain Stability | Encouraging nearshoring and regional procurement | Lower dependence on volatile foreign suppliers |

| Innovation and Economic Growth | Increasing investment in R&D and technology adoption | Stronger sustainable economic development |

Final Thoughts: The Enduring Impact of Tariff Enforcement

The appellate court’s ruling to maintain the Trump-era tariffs ensures these trade policies will continue to influence U.S. economic and trade strategies in the near future. Industry leaders and government officials remain watchful as legal proceedings progress, fully aware of the tariffs’ extensive effects on international trade and domestic markets. Upcoming developments in this case will be pivotal in shaping the future course of U.S.-China trade relations and broader economic policy frameworks.