As the year draws to a close, small business owners across the country face a critical deadline to comply with federal reporting requirements designed to enforce transparency and accountability. According to USA Today, failure to submit the necessary reports by the end of the year could result in significant penalties, underscoring the importance for entrepreneurs to stay informed and meet these legal obligations on time. This development highlights ongoing federal efforts to ensure regulatory compliance among America’s small business sector.

Small Business Reporting Requirements Under New Federal Law Explained

Small business owners across the country face critical reporting deadlines as new federal regulations require timely submission of financial and operational data. Failure to comply by December 31 may trigger steep fines and increased scrutiny from regulatory agencies. Key reporting obligations include:

- Quarterly revenue disclosures to ensure transparency and verify eligibility for tax credits.

- Employee payroll and benefits documentation to support labor compliance audits.

- Updated business ownership information to maintain accurate federal registries.

To streamline compliance, the Small Business Administration (SBA) has introduced an online portal designed to help owners submit required data efficiently. Below is a summary of critical deadlines and potential penalties for missed submissions:

| Deadline | Requirement | Penalty |

|---|---|---|

| December 31 | Complete annual revenue report | $500 fine per late day, max $10,000 |

| December 31 | Submit payroll & benefits data | Possible federal audit initiation |

| December 31 | Update ownership info | Business license suspension risk |

Key Deadlines and Consequences of Missing Year-End Reporting Obligations

Small business owners must be vigilant about key deadlines that federal agencies enforce strictly. Most year-end reports, including tax returns and employment filings, are required by December 31 or early January of the following year. Missing these critical deadlines can trigger a cascade of negative consequences such as financial penalties, interest on unpaid amounts, and potential audits. For example, failure to file the IRS Form 1099 by January 31 can result in fines ranging from $50 to $280 per form, depending on how late the submission is.

Understanding the specific due dates and the penalties for non-compliance is vital to safeguard your business finances. Below is a quick reference table of common year-end reporting deadlines and their related penalties for U.S. small businesses:

| Report | Deadline | Penalty for Late Filing |

|---|---|---|

| IRS Form 1099 | January 31 | $50–$280 per form |

| W-2 Forms | January 31 | $50–$280 per form |

| Quarterly Estimated Taxes | January 15 (Q4) | Interest plus penalties |

| Annual Tax Return | April 15 | Up to 25% of tax due |

- Late Fees: Accumulate daily until the filing is complete.

- Increased Scrutiny: Could trigger audits from the IRS or the Department of Labor.

- Loss of Benefits: Missing filings can jeopardize eligibility for federal grants and loans.

How to Prepare Accurate Financial Documentation for Compliance

Ensuring your financial records meet federal compliance standards begins with implementing a robust documentation process. Start by organizing all transactional data, including receipts, invoices, and bank statements, in a secure and accessible manner. Use accounting software that supports audit trails and timestamped entries to maintain integrity and accuracy. Regular reconciliations between your books and bank statements help identify discrepancies early, reducing the risk of errors that can trigger penalties. Key elements to include:

- Comprehensive records of income and expenses

- Proper categorization of transactions

- Up-to-date payroll documentation

- Timely entries to prevent backlog

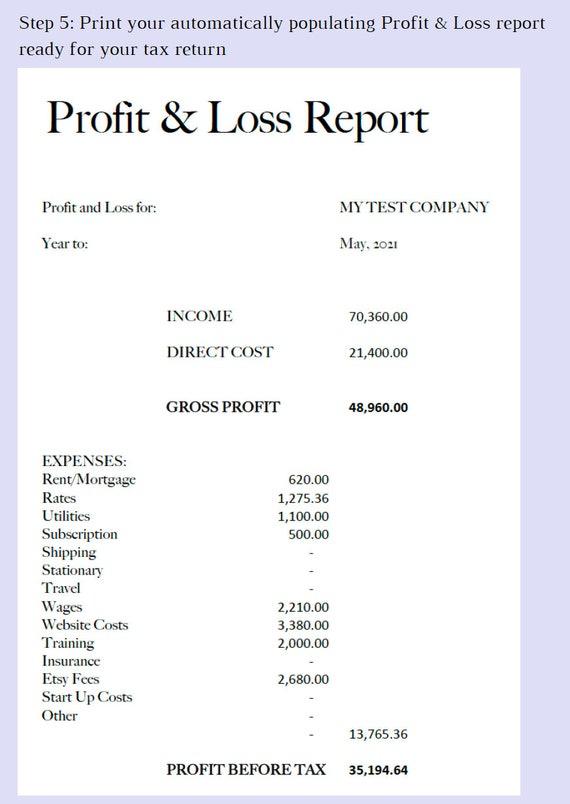

Additionally, make use of clear and concise financial reports that can be easily reviewed by auditors or government officials. Templates such as profit and loss statements, balance sheets, and cash flow reports should be standardized and regularly updated. Below is an example of a simple compliance checklist to keep your preparedness on track:

| Task | Frequency | Status |

|---|---|---|

| Update general ledger | Weekly | âś” Completed |

| Reconcile bank accounts | Monthly | âś” Completed |

| Review payroll records | Bi-weekly | Pending |

| Backup financial data | Daily | âś” Completed |

Expert Tips for Small Business Owners to Avoid Penalties and Audits

To stay compliant and steer clear of costly penalties, small business owners should prioritize accurate and timely tax reporting. The federal government mandates comprehensive documentation of income, expenses, and employee information before the year ends. It is crucial to:

- Verify all financial records for completeness and accuracy.

- Keep up-to-date payroll records to avoid discrepancies that trigger audits.

- File all required forms such as W-2s, 1099s, and quarterly tax returns on time.

Implementing a system of regular internal audits can significantly reduce risks. Establishing clear protocols for document retention and utilizing accounting software integration often reveals errors before they escalate. Consider this checklist of common triggers that can invite federal scrutiny:

| Audit Trigger | Preventive Action |

|---|---|

| Large discrepancies in reported income | Reconcile bank statements monthly |

| Underreporting payroll taxes | Use automated payroll services |

| Missing or late filings | Set calendar reminders for deadlines |

| High deduction claims disproportionate to income | Maintain detailed receipts and invoices |

Key Takeaways

As the year draws to a close, small business owners across the country face a critical deadline to comply with new federal reporting requirements. Failure to submit the necessary information on time could result in significant penalties, underscoring the importance of timely action. Staying informed and prepared is essential to avoid costly repercussions and ensure continued business operations under the evolving regulatory landscape.