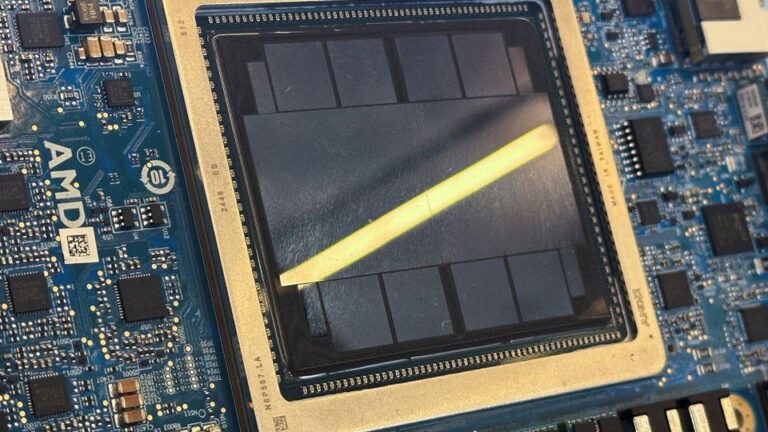

Advanced Micro Devices (AMD) has secured a landmark chip supply agreement with OpenAI, a move that is projected to add a staggering $80 billion in market value to the semiconductor company. Following the announcement, AMD’s stock surged by 34%, reflecting investor confidence in the partnership’s potential to accelerate growth and innovation in artificial intelligence technology. This deal underscores AMD’s expanding role in powering next-generation AI applications, positioning the company at the forefront of a rapidly evolving industry.

AMD and OpenAI Partnership Signals Major Shift in AI Hardware Landscape

The groundbreaking agreement between AMD and OpenAI is reshaping the competitive landscape of AI hardware, marking a pivotal moment for the semiconductor industry. By securing this high-profile chip supply deal, AMD not only solidifies its position as a key technology partner for AI innovators but also positions itself at the forefront of next-generation computing power. This partnership directly challenges established players by enhancing AMD’s capabilities in producing the custom silicon designs that drive advanced AI models, which demand unparalleled performance and efficiency.

Industry experts highlight several implications of this collaboration:

- Market Impact: AMD’s valuation is expected to soar, driven by increased demand for AI-specific processors.

- Technological Innovation: Co-developed chips optimized for OpenAI’s models promise faster training times and reduced energy consumption.

- Strategic Positioning: This deal may trigger further alliances and acquisitions within the AI hardware ecosystem, emphasizing specialized chip architectures tailored for AI workloads.

| Key Metrics | Pre-Deal | Post-Deal Projection |

|---|---|---|

| Stock Price Increase | 16% | 34% |

| Estimated Value Addition | $35B | $80B |

| AI Market Share | 15% | 28% |

Implications of the $80 Billion Valuation Surge for Tech Investors

The unprecedented $80 billion surge in AMD’s valuation following its chip agreement with OpenAI has shifted investor sentiment across the tech sector. This sizable increase emphasizes the market’s growing confidence in AMD’s ability to capitalize on the lucrative AI hardware market, positioning the company not just as a competitor, but as a cornerstone supplier in next-generation computing. Investors are increasingly viewing partnerships like this as key indicators of sustainability and growth in an otherwise volatile industry.

For tech investors, this monumental jump entails several strategic considerations:

- Portfolio Diversification: Adding stakes in companies with strong AI collaborations could safeguard against market fluctuations.

- Risk Assessment: Recognizing that such large valuation jumps may attract speculative trading and increased volatility.

- Long-term Gains: Identifying firms with cutting-edge technology alliances as potential long-term value drivers.

| Metric | Before Deal | After Deal |

|---|---|---|

| Stock Price Increase | 0% | 34% |

| Valuation Gain | Baseline | +$80 Billion |

| Market Sentiment | Neutral | Highly Positive |

Analysis of AMD Stock Performance Following the OpenAI Chip Deal

AMD’s stock experienced a remarkable surge of 34% immediately following the announcement of its landmark chip deal with OpenAI. This move significantly bolstered investor confidence, reflecting optimism about AMD’s expanding role in powering next-generation artificial intelligence systems. The partnership positions AMD as a key supplier for OpenAI’s advanced computing needs, potentially translating into substantial long-term revenue growth and enhanced market share in the semiconductor industry.

Key factors driving this bullish sentiment include:

- Anticipated $80 billion increase in company valuation, signaling robust future earnings potential.

- Strengthened competitive edge

- Accelerated innovation pipeline

| Stock Indicator | Value | Change |

|---|---|---|

| Opening Price | $95.40 | +34% |

| Market Cap Impact | +$80B | +20% |

| Trading Volume | 150M Shares | +45% |

Strategic Recommendations for Investors Navigating the AI Chip Market Boom

Investors should prioritize companies that demonstrate strong strategic partnerships with leading AI innovators, like AMD’s recent agreement with OpenAI. Such alliances not only validate the tech’s potential but also offer a direct path to high-value contracts and accelerated revenue growth. Diversification within the AI chip sector remains critical, as competition intensifies among manufacturers deploying next-gen silicon architectures tailored for machine learning workloads. Keeping a close watch on emerging players who specialize in niche AI applications could uncover early-stage opportunities with outsized returns.

Market volatility is expected as governments and enterprises escalate investments in AI infrastructure, so a disciplined approach to portfolio allocation is essential. Consider the following key indicators before making investment decisions:

- Technological moat: Proprietary innovations that provide competitive advantage

- Supply chain resilience: Ability to navigate silicon shortages and logistic disruptions

- End-market diversification: Presence across cloud computing, autonomous vehicles, and edge AI

- Regulatory environment: Anticipated government policies influencing semiconductor exports and AI ethics

| Factor | Impact on AI Chip Stocks | Investor Action |

|---|---|---|

| Strategic Partnerships | High valuation growth, increased stock momentum | Target companies with marquee collaborations |

| Technological Innovation | Long-term competitive edge | Monitor R&D spending and patent acquisitions |

| Supply Chain Stability | Operational continuity and margin protection | Assess supplier diversity and inventory management |

To Conclude

The landmark agreement between AMD and OpenAI marks a significant milestone in the technology sector, underscoring the growing influence of artificial intelligence in the semiconductor industry. With the deal adding an estimated $80 billion in value to AMD, the company’s impressive 34% stock surge reflects strong investor confidence in its role as a key supplier for AI advancements. As AI continues to reshape global markets, AMD’s partnership with OpenAI positions it at the forefront of innovation, signaling promising growth prospects for both companies in the years ahead.